A comfortable retirement requires savvy financial housekeeping

Linda Leitz: After hitting short-term financial goals, “deposit extra cash to retirement savings. …When incomes increase, increase retirement deposits.” Photo by Patrick Cavan Brown.

For a comfortable retirement: Budget, manage debt and save. “It’s really a triage approach,” says Linda Leitz, chair of the National Association of Personal Financial Advisors. “Otherwise you’re going to have to work to the day you die. Dying at your desk may sound like a good financial plan if you love what you do—until or unless something gets in the way, such as an illness or obligation to a family member that makes earning a paycheck difficult.”

Take these money-management steps, and check ABAJournal.com for additional retirement-planning resources.

Set goals. “Consider how and what you are saving, financing and for what purposes,” Leitz says. “Budget to have a 10 to 20 percent cushion for long-term goals such as paying off a mortgage or retiring, and a cushion for emergencies.” Mint.com offers budgeting tools.

Pay off debt. Interest paid on debt is less money deposited to retirement savings. “Credit card debt is toxic. Student loans, depending on the rate and outstanding balance, are not horrible. But I recommend aggressively getting rid of consumer debt first,” says Leitz. Add up debt beyond a mortgage—student loans, credit cards, car loan, child or alimony payments. “If it’s 36 percent of your income,” she says, “you’re pushing it.”

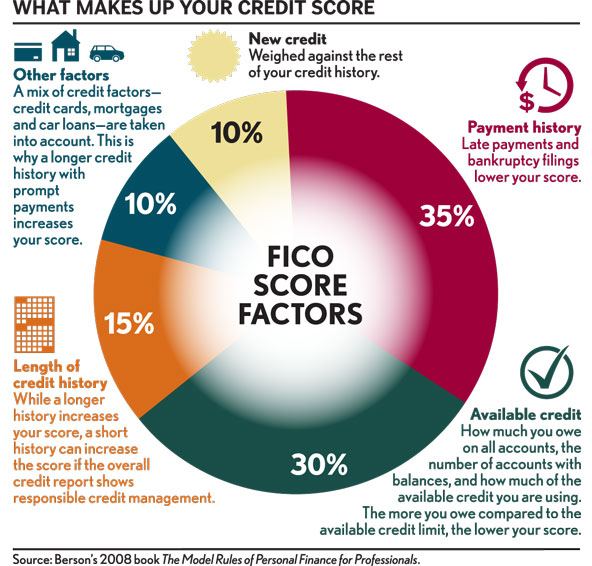

Achieve good credit. “The higher your FICO score, the lower your interest rates, which saves money,” says Anthony Sprauve, a spokesman for the Fair Isaac Corp., the analytic software company that created the FICO score. Understanding FICO’s model helps a consumer positively boost a score for the best interest rates. “Essentially, your past repayment of debt is used as a predictor of payment in the future,” Sprauve says.

January 2014

- • Road to retirement: Ways to make retirement anything but resignation

- • How lawyers can dig themselves out of debt and plan for a future (podcast with transcript)

February 2014

March 2014

April 2014

WEBINAR

Download a webinar on retirement issues for lawyers, recorded on March 26, 2014. (Windows Media file)

“Establishing a track record of timely payment is important. But showing you can manage debt, such as opening new credit only when necessary, is also important,” he says.

“New accounts have the effect of lowering the score because the FICO calculation is driven by your history with credit; that’s repayment over time. The score doesn’t care if you have one or 10 credit cards—just that you’re keeping balances low, paying timely and managing the debt responsibly.”

Live within your means. “A lender may offer to lend up to 2½ times your income,” Leitz says. “Now, if you can benefit from the mortgage’s tax deduction and stay on track with the payments, that ratio may not financially harm you, but if you’re upgrading to a home and mortgage payment that’s two or three steps ahead of what your realistic earning capacity is, you’re headed for trouble,” she adds.

“Generally, a ‘right size’ home is 1½ — but no more than 2½ — times your household income, taking a mortgage that’s 60 to 80 percent of the home’s purchase price.”

Resist temptation. Look at whether you’re financing a lifestyle or advancing long-term goals. If that vacation you took six months ago is still costing you in credit card interest, there’s no value compared to paying interest on debt for your home.

Save. “Overall, real estate should not be more than one-third of your net worth, and the impact of inflation and taxes has to be hedged. After hitting those short-term goals, deposit extra cash to retirement savings,” says Leitz.

“Compound interest is what helps you, and it [adds up] the earlier you start saving. When incomes increase, increase retirement deposits.”

Married? “Couples who paid off their debt early in their relationships reported higher satisfaction with their marriages,” says Jeffrey Dew, a Utah State University assistant professor who studies money, debt and its impact on families.

“But it’s not how much money a couple has, but whether they are in agreement about what to do with it,” he says. People bring different views about money to relationships. “When it comes to how you view money—what it means and what it should be used for—couples who discuss it and agree on goals,” Dew says, “are less likely to divorce over it.”

This article originally appeared in the February 2014 issue of the ABA Journal with this headline: “Triage Time: A comfortable retirement requires savvy financial housekeeping.”

Graphics by Adam Weiskind

Susan A. Berson is a Leawood, Kan.-based attorney and author of several finance and tax books for lawyers. She will continue her articles on retirement next month, discussing how to avoid retirement portfolio panic.