ABA Treasurer's Report

Alice Richmond

Photo by Stephen Sherman

If, as Boris Pasternak, that great Russian writer, wrote “[s]urprise is the greatest gift which life can grant us,” then I have been gifted beyond my wildest expectations during my first six months as Treasurer of the American Bar Association.

Throughout my candidacy and my term as Treasurer-elect, the economy was booming and, with the good stewardship of Bill Robinson, my predecessor as Treasurer and other Association leaders, as well as prudent financial management by our professional staff, the Association ended each year with a healthy surplus. We used this surplus to realize our mission of defending liberty and pursuing justice by supporting a broad spectrum of programs and services, both in the United States and abroad, benefiting both the public and our members. The Association’s activities will certainly be impacted by the economic turmoil of the past few months and my future reports to you will deal with our projections for the Association’s position in this new economic order. However, by definition, an “annual report” looks backward and we ought to take this moment to celebrate some of the real economic achievements of our fiscal 2007-2008 year which ended on August 31.

SIGNIFICANT FINANCIAL ACCOMPLISHMENTS IN FISCAL YEAR 2008

As of August 31, 2008, Association revenues—that is the money coming in the door from dues, investments, meetings, publications and other sources of non-dues revenue, exceeded our expenses by $3.9 million for our General Operations. This surplus enables us to transfer $3.9 million to the Dues Warehouse to further delay a dues increase. In addition, during the fiscal year we (1) reduced our debt related to the purchase of our DC headquarters and the build-out of our Chicago offices by $2.7 million; (2) provided an additional $500,000 to the Enterprise Fund which encourages cooperation and collaboration among ABA entities working on joint projects and programs, and (3) transferred $14.5 million to our Permanent Reserve to meet our target of having “50% of our gross operating expenses” in reserve. We had clean audits from Ernest & Young for all Association activities including the very picky A-133 audit of funds the ABA received from the federal government. The combined audit included the ABA, the FJE, the ABA Museum and the James O. Broadhead Corporation, a real estate holding company which owns the ABA’s Washington headquarters building. In addition, we contributed $5.4 million out of cash reserves to the AEFC Pension Plan, the Association employees’ pension plan, to satisfy the full-funding requirements of the defined benefit plan under ERISA.

OTHER FINANCIAL RESULTS FOR THE FISCAL YEAR 2007-2008

In preparing the year end reports, the Association’s financial services staff prepares a consolidated balance sheet report which includes the assets, liabilities and net assets of the American Bar Association and all of its related entities including the Fund for Justice and Education, the ABA Museum and the James O. Broadhead Corporation which are then reviewed by Ernst & Young, the Association’s auditors. As of August 31, 2008, the Association’s consolidated net assets totaled $154 million, a 19% decrease from the prior year. More than 75% of the Association’s $272 million in assets, are cash, cash equivalents and long-term investments. The ABA’s combined consolidated liabilities at year’s end were $117 million; $5 million higher than the prior fiscal year. This increase was due primarily to a $9.4 million increase in the ABA’s pension liability under the relevant ERISA pension calculation requirements. Nevertheless, the Association’s operations, including Section and grant activities, generated cumulative operating revenue over expenses of $7.2 million. Given the economic upheaval that began during mid-2008, it is not surprising that the ABA’s long term investment reserves decreased by $16 million. As bad as this is, our results were better than many organizations, a fact which is largely attributable to what we trustees call “prudent financial management” and for that we can thank not only our able financial services team led by Hank White but the volunteer leadership throughout the Association as well, particularly those who are budget officers and perform other financial oversight and auditing functions.

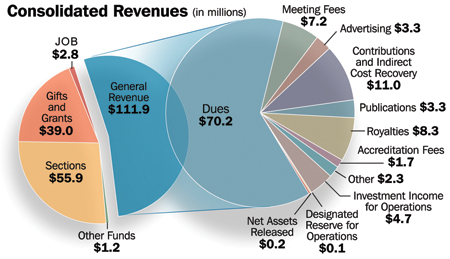

The Association’s operating revenue—defined as the funds used to support the Association’s day-to-day activities—was $211 million and came from several sources. Dues revenue, at $70.2 million, continues to be the Association’s largest revenue source. Section dues revenue added another $15.8 million. In the non-dues revenue category, meeting fees continue to be a strong source of income to the Association with the sections generating $21 million in meeting fees while the ABA’s General Operations brought in $7.2 million. It is clear that our members find real value in these meetings and we ought to encourage and support these activities. Externally funded domestic and international programs, mostly in federally financed grants which flow through the Fund for Justice and Education, accounts for nearly $40 million. Figure 1 below illustrates the mix of these revenue sources.

Chart by Jeff Dionise

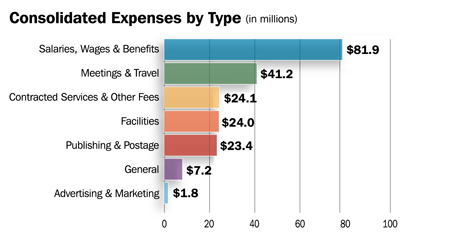

The Association’s consolidated operating activities also generate expense which is, if you will, the “flip side” of the revenue picture. For fiscal 2007-2008, expenses for general operations, section activities, grant programs, the James O. Broadhead Corporation and the ABA Museum were $204 million, a 7% increase over fiscal 2006-2007. Expenses in this context include everything from personnel costs, travel, hotel and other meeting expenses, and printing and postage for our many publications. Figure 2 below illustrates the various expense categories across the Association.

Chart by Jeff Dionise

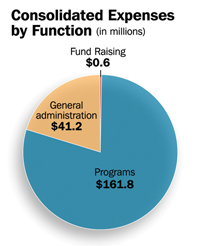

Figure 3 (below) illustrates the large percent of ABA expenses dedicated directly to our programs compared to the amount spent on supporting services like finance and information technology. The ratio of program expenses to total expenses is often a gauge of a not for profit organization’s efficiency; the higher the ratio, as illustrated in this chart, the less money is used to pay overhead expenses.

Chart by Jeff Dionise

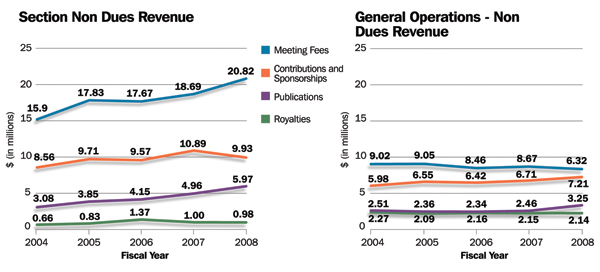

FISCAL 2007-2008 SECTION ACTIVITIES

It is my firm belief that the long term viability of this Association lies in the vitality of its sections. Throughout my years as an ABA member, we have seen increased professionalism in section programs and presentations and sustained growth in its non-dues revenue categories. Fiscal 2007-2008 was no exception. As of August 31, 2008, Section cash and long term investment reserves totaled over $184 million dollars. Combined section revenue at almost $56 million is a 4% increase over the prior year and exceeded the $54 million of section expenses by $2.2 million. This surplus of section revenue over section expense is even more notable given the fact that combined section expenses increased by over 14%. Not surprisingly, almost half of the section expense increase was in the meetings and travel category. Figure 4 (next page, right) is a comparison of non-dues revenue categories between the sections and the ABA general operating fund for the past five years.

NON-OPERATING FUNDS CATEGORY

The non-operating funds category includes revenue not designated to be used for operations (e.g. investment income above the budgeted amount), losses from investments and non-recurring or extraordinary items. An examination of the ABA’s Consolidated Net Asset report will show a $35 million decrease in net assets from fiscal year 2007 to fiscal year 2008. This number is in stark contrast to the net asset increases of $28.2 million and $31.2 million in the previous two years’ audits. While this is a large enough number to focus our attention, it is not as alarming as it first seems. This is so because there were several extraordinary items which needed to be reported according to Generally Accepted Accounting Principles (GAAP) but do not, with one exception, have an impact on ABA operations.

One item is a $21.7 million decrease in the ABA’s long term investment balance. Approximately $16 million of this $21.7 million decrease is due to loss of market value in the ABA’s long term investment portfolio. The remaining $5.7 million decrease is the amount of long term investment income allocated to our operating budget. In most years, this amount is far less than actual investment income. This year, however, because of the precipitous decline in market value, that was not the case. Consequently, in the absence of an offsetting amount from investment growth, this $5.7 million budget amount must literally be deducted from our long term investment column. No securities were sold but, for accounting purposes, we must show this as a decline in value of our investment portfolio.

The second item contributing to our consolidated net asset decline was the $12 million increased pension liability. Please believe me when I tell you that the pension calculation is very complex. Suffice it to say here that this pension liability change was based on an actuarial calculation which is dependent on current interest rates as well as the value of the assets in the pension plan. Without knowing any more than that, you can now understand why the decrease in the market value of the assets held by the pension plan will cause the ABA to have a much higher pension liability during the next few fiscal years at least.

Finally, the third major item involved in the decline in our consolidated net assets has to do with the amount and duration of depreciation of our technology equipment. As anyone who has ever held last year’s blackberry or laptop knows, today’s next newest thing becomes obsolete, or certainly superseded, very rapidly. The Internal Revenue Service has issued guidelines for depreciating technological equipment and the Association has now adopted the IRS guidelines. Because of the resulting change in methodology, it has been necessary to write off the remaining value of some capitalized technology equipment. This write-off is, in its most basic form, a change in the way in which we account for certain equipment; it is not any outflow of cash, per se, but it does have a one time impact on our net assets because some equipment is now fully depreciated, or, in simple terms, has a zero value on our books.

The combination of these three factors on the “non operations” side of the ledger has caused the decline in our net assets. A continued poor performance by the financial markets will probably result in another decline in the ABA’s consolidated net assets for the next fiscal years as well.

A VIEW OF THE CURRENT ECONOMIC CONDITIONS

The current turmoil in the financial markets caused moderate losses to the Association’s long term investments during the fiscal year 2007-2008. The ABA “Permanent Reserve” is, as the name suggests, our hedge against swings in revenue and other unforeseen events having an economic impact on the Association’s activities. As a general policy, it is prudent to have 50% of an organization’s annual general operating expenses in such a “reserve”. In March 2008, the Permanent Reserve had $56.7, meeting our 50% target, as a result of the transfer of $14.5 million from the ABA surplus. As of August 31, 2008, the ABA’s Permanent Reserve was down to $50.2 million, which is approximately 46% of our annual General Operating expenses of $108 million. By October 31, 2008 the Permanent Reserve stood at $46 million, a drop of more than $10 million in the seven month period. Things improved slightly and then took a severe downward turn after the presidential election, and as of January 31, 2009, the Permanent Reserve is now at $37 million. Needless to say, we are well below our 50% of operating expense target and we will need to use the same discipline to replenish this important part of the Association’s solid financial foundation.

Chart by Jeff Dionise

In most years, the Association’s long term investments generate significant income, particularly as the value of the Association’s portfolio rises. However, since we hold the investments for long term growth, we have what is generally referred to as “unrealized gains.” In order to receive the benefit of these unrealized gains, the Association has used what is commonly called “the endowment approach.” To do this, we take an average market value of our investment balance over a period of the prior three years or 12 quarters and allow a small percentage of that average market value to be “spent” each year by inserting into the budget a figure which represents that amount. Although we will continue to use this methodology to reduce volatility in our budgeting process, if the market continues to decline, the three year trailing average will also decline. The result for the Association will be less money for the Association’s programs and services.

Nevertheless, and despite the grim economic news, we—that is your officers and representatives on the Board of Governors, along with our professional financial services staff, hope to be able to maintain the same dues pricing for a fifth year and perhaps even beyond. Our capacity to hold the line on a dues increase is related to two things; controlling and probably reducing expenses and increasing revenue from both dues and non dues categories. As to the first, Hank White has already formulated contingency plans to cover severe revenue shortfalls should they materialize this fiscal year and all Association entities have been carefully examining how expenses can be reduced, particularly in the meetings and travel categories. Although we have seen some softening in our dues revenue to date, we are working hard to retain existing members and attract new ones. I urge all of you to encourage members of your own firms and lawyers in your communities either to become members or stay members, especially at this crucial time when there are so many opportunities for service and such a need for our efforts. Throughout the coming year, I will be talking about our non-dues revenue categories and inviting you to become more involved in selecting products and services from companies which support the Association either through member benefit programs or as advertisers for section and other ABA programs and events.

IN CONCLUSION

It is an honor to be the Treasurer of this great Association even in these tumultuous times. I have learned a great deal in a very short time and I would be remiss if I did not thank our professional financial services staff, Ken Widelka, our not so new CFO and, especially Kay Geary, our super competent Controller who has shown extraordinary patience with a new Treasurer on a steep learning curve. Without them, and their cooperative staffs, my role as the volunteer Treasurer of this huge and sprawling entity called the American Bar Association would be nearly impossible.

The more I see of what we, as an organization, do, the more I understand how the efforts of each of us contribute to achieving the goals of defending liberty and pursuing justice. I am proud of the good works that go on day after day, week after week throughout the Association. The projects and research of the Fund for Justice and Education and the American Bar Foundation, one of whose research professors just won the prestigious 2009 Stockholm prize in criminology, are the source of much of this important work which, itself, would not be possible without the large grants both FJE and ABF receive from, the American Bar Endowment. Those grants are partially funded by insurance dividend donations made by ABE’s insured members. Let me express my appreciation for any part you had in supporting their important work, particularly in these difficult financial times and invite everyone to go on line to see if the ABE insurance program will satisfy your needs while providing the opportunity for charitable giving to a very worthy cause.

So many of you have already taken the opportunity to ask me about the financial health of the Association and to offer suggestions and ideas about how we might do better. I am grateful for all those comments and I look forward to continued communications from you. I promised to increase transparency and understandability of our financial reports and I would be grateful for any feedback about how we are doing in that regard. If you would like a copy of the ABA’s audited consolidated financial statements for the year ended August 31, 2008, please send an email either to me or to Nadine Nunley, Ken Widelka’s very efficient executive assistant, at .(JavaScript must be enabled to view this email address). Finally, if you have any questions or comments about this Treasurer’s Report or any aspect of Association finances, please contact me at .(JavaScript must be enabled to view this email address). I promise to get back to you as rapidly as I can. In the meantime, thank you again for your support and your interest in the financial health of the Association.