ABA Treasurer's Report: Fiscal year ending August 31, 2013

ABA Treasurer Lucian T. Pera

The ABA’s finances are sound.

That’s been the headline of my two prior reports to you, and it remains true.

It’s also true that this year, my last as your Treasurer, our Association’s finances look better than they have during my term, and better than they have in a number of years. We continue to have financial issues we need to address, but there’s a leadership consensus identifying the issues; we have a specific, agreed plan to address them; and our staff and volunteer leaders are steadily working that plan.

THE BIG PICTURE

As of the end of last fiscal year, FY2013, the ABA had a healthy balance sheet.

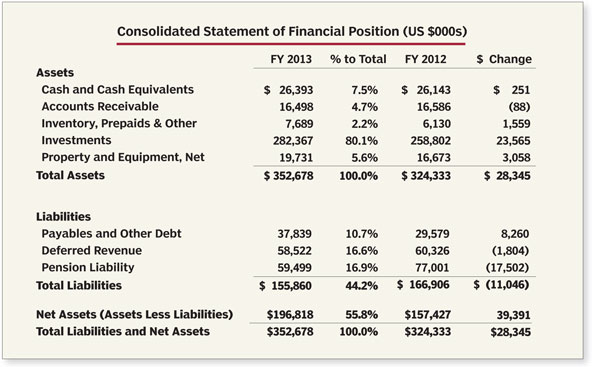

Largely thanks to non-operating results, the ABA’s balance sheet strengthened again this year. The ABA’s net assets of $196.8 million (assets over liabilities) at the end of the fiscal year in August 2013 increased by $39.4 million over net assets at the end of FY2012. You may recall that, as of the end of FY2012, net assets had increased by $25.1 million over the nets assets as of the end of FY2011. The key factors that drove the FY2013 result were strong investment results and a significant decrease in our pension liability. The Association has benefited from a strong investment market and a decrease in pension liability due to a rise in interest rates. Moreover, cash and marketable securities comprise 88% of the ABA’s assets, the same proportion as at the end of FY2012, and the ABA has extremely little debt.

At the same time, for several years, as I have reported to you, our revenue and expenses—our operational finances—have been a cause for concern and need our attention. Here, I refer to General Operations—the ABA’s operations not including the Sections or our grant-funded activities. Earlier this year, careful and reasonable projections showed that, if we assumed that current programs and operations continued at roughly the same levels, then, based on reasonable financial assumptions (including projected new non-dues revenue sources), and without a dues increase, the expense of these programs and operations would have exceeded revenue, over the next three years, by about $28.3 million—$6.5 million (FY2015), $9.4 million (FY2016), and $12.4 million (FY2017). The reasons include declines in dues and non-dues revenue and inflation, and the fact that the ABA has not had an increase in dues rates in eight years.

THE PLAN

To address this instability in our core financial operations, the Board of Governors, led by its Finance Committee, formulated a four-part plan. Now that the House of Delegates has acted at the February 2014 Midyear Meeting, all four pieces are now firmly in place.

First, over the last three years, Senior Management and the Board of Governors, led most especially by Executive Director Jack Rives and former CFO Larry Gill, have aggressively cut and contained expenses, and those efforts will continue.

Second, the Board took a fresh, hard look at our use of reserves and adopted a revised reserves policy. That new policy prudently safeguards the legacy that is our reserves, but adjusts the endowment method by which we use a portion of the reserves each year, adding about $300,000 a year for use in operations. That will allow us to use, on average, about $9.7 million from reserves each of the next several years for operations.

Third, the Board has tasked Executive Director Jack Rives and Senior Management with radically growing our net non-dues revenue. This broad-based effort, called ABAction!, is projected to generate at least $5.6 million in new net non-dues revenue over the next three years. We’re hoping for more.

Fourth, culminating a multi-year process of study by the Board, its Finance Committee, and the Pricing Strategy Advisory Committee chaired by Joe O’Connor of Indiana, the House approved in February a roughly 13% dues rate increase for virtually all dues categories. This increase is lower than either of the last two dues increases—the ones in 2004 and 2007—and the proposed dollar increases range from 15 to 50 dollars. This dues increase also included a unique feature: an optional cost-of-living-adjustment (COLA) increase in dues rates, for each of the next three years, limited annually by the Consumer Price Index. Significantly, the House also authorized the Board of Governors to eliminate or reduce each of these annual COLAs, but not to increase them. For more detail on our plan and the reasons supporting the dues rate increase, see House Resolution 177C and the supporting report by clicking this link for the PDF version.

With this plan in place, that projected three-year deficit of $28.3 million will be reduced to about $4.0 million over those three years—yielding enough new revenue (when combined with new non-dues revenue) to bring stability to our operational finances. As your Treasurer, I firmly believe this plan puts our Association—especially including its core operational finances—on a sound footing for the future.

LAST YEAR’S RESULTS

Turning to our financial results, the Association’s financial statements for the fiscal year ended August 31, 2013, were finalized at the Midyear Meeting and approved by the Board of Governors. You can review these financial statements and the clean, unqualified audit report from our auditors, Grant Thornton, by clicking this link for a PDF version.

As I noted above, the Association’s finances remain strong as our Net Assets increased significantly during the year. That increase was driven, however, by two non-operating items: strong investment results and a decline in our pension liability due to an increase in interest rates.

FY2013 CONSOLIDATED RESULTS

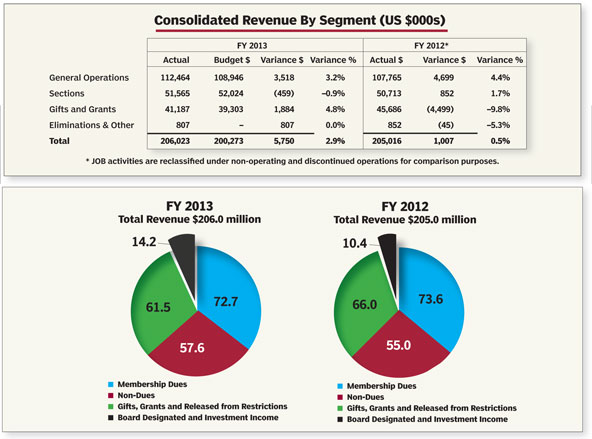

The Association’s overall FY2013 consolidated results were positive. Consolidated FY2013 revenue of $206.0 million was $5.7 million, or 2.9%, over budget, due mainly to investment income, membership dues, net assets released from restriction and meeting fees. Investment income was favorable to budget due to the market performing well and conservative budgeting; membership dues results were favorable to budget due to conservative budgeting; and net assets released from restriction were not reflected in the budget.

While consolidated FY2013 revenue was $5.7 million better than budget, it was only $1.0 million, or 0.5%, greater than FY2012.

Board-designated reserves used to fund operating expenses were $6.5 million and $3.7 million for the fiscal years 2013 and 2012, respectively. In addition, on an annual basis, the Board has authority to allocate a specific portion of investment income to operating revenue. Investment income allocated to operations in 2013 and 2012 totaled $7.7 million and $6.7 million, respectively. Aside from the increases in Board-designated reserves to fund operating expenses, and excluding the allocation of investment income, other operating revenue has been slowly declining over the years. Membership dues of $72.7 million for FY2013 have been decreasing each year since FY2007, when dues were $86.0 million. Dues rates have not increased since FY2007 and membership has experienced a slight year-over-year decline. Gifts and grants have also declined, from $66.0 million in FY2012 to $61.5 in FY2013. Most of the ABA’s grant activity is with U.S. Government agencies. The decrease reflects the impact of grantors shifting priorities as to where grant resources are being allocated and the gap between adding enough new grants to offset or replace grants that ended. Non-dues revenue has increased $2.6 million, from $55.0 million in FY2012 to $57.6 million in FY2013, as a result of added meeting fees, royalties, and an increase in accreditation fees.

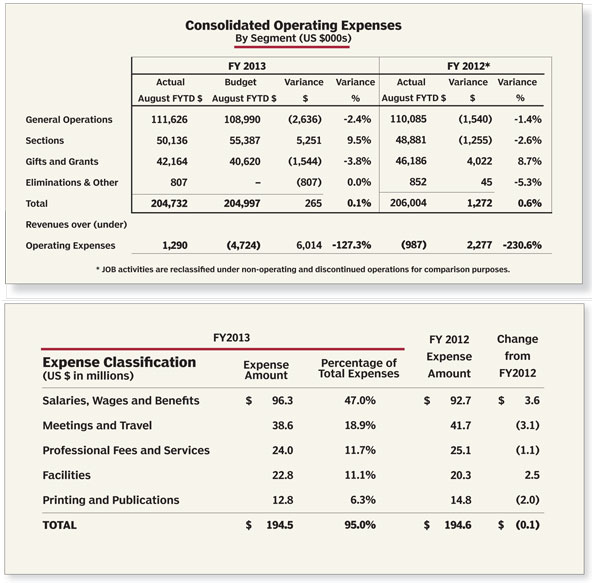

As a result of effective expense management, FY2013 consolidated operating expenses of $204.7 million were $1.3 million below FY2012 consolidated operating expenses. Of our seven expense reporting lines, five accounted for 95% of the ABA’s total operating expenses. Of these five, three reflect lower year-over-year amounts, with salaries, wages and benefits, and facilities reflecting increases. The increases in salaries, wages and benefits reflect merit increases along with higher pension costs and health insurance costs. Facilities expense increased due to the accelerated amortization of leasehold costs on the ABA’s prior Washington, D.C., lease. In order to keep costs in line with operating revenues, the Board and senior management have effectively managed expenses in the last few years. A number of cost-saving initiatives have reduced or limited expense growth. For example, during the recession, merit increases were eliminated and, in August 2010, a headcount reduction was implemented. In addition, the ABA’s space needs in the Chicago office were evaluated and re-designed, with operations being consolidated from eight floors to seven floors, leading to lease renegotiations and savings of more than $12.4 million over the eight years remaining in the original lease. Just this past year, policies were established to quantify and retain savings from open positions. Further, professional services were reduced due to a new review process to challenge all professional services costs.

To ensure its long-term viability, the ABA is significantly ramping up its efforts to generate non-dues revenue. The Board has specifically tasked Executive Director Jack Rives with ABAction!, the ABA’s non-dues revenue growth initiative. Under Larry Gill’s leadership as our new Deputy Executive Director and Chief Revenue Officer, I am confident we will see tangible results from ABAction! this year.

STRONG BALANCE SHEET

As I noted above, the ABA’s non-operating results last year led to a stronger ABA statement of financial position. The ABA’s net assets of $196.8 million (assets over liabilities) increased by $39.4 million over its net assets as of the end of FY2012. Moreover, cash and marketable securities (investments) comprised 88% of the ABA’s assets in both FY2013 and FY2012. During the fall, Financial Services staff worked hard to transition our investments to a new investment advisor, Russell Investments. This choice was approved by the Finance Committee and the Board in June 2013. The transition went very smoothly, with excellent education efforts by Russell, including extensive participation at the Section Officers Conference fall meeting. The increase of $3.0 million in net property and equipment is mainly due to the ABA’s new Washington, D.C., leased office space. In conjunction with this lease, the landlord made office build-out contributions for tenant improvements (reflected in a deferred rent abatement in the balance sheet’s Liability section) in excess of $6.0 million last year.

Of the ABA’s FY2013 year-end net assets of $196.8 million, all but $10.2 million were unrestricted. The $10.2 million in restricted net assets represents amounts that donors have contributed subject to restrictions on use. Of the remaining $186.6 million unrestricted net asset balance, the ABA Board has designated $112.6 million for specific purposes.

PENSION LIABILITY

The ABA’s pension liability decreased as of the measurement date of August 31, 2013. Interest rates are one of the key drivers of our overall unfunded pension liability—the higher the rate, the lower our cumulative liability; the lower the rate, the higher the overall liability. The pertinent rate increased from 3.97% as of August 31, 2012, to 4.91% as of August 31, 2013. Largely as a result of that change, the ABA’s total pension obligation is now $166.9 million, a 9.3% drop from last year’s total of $184.0 million. As also reflected in the accompanying chart, our unfunded pension liability dropped $17.5 million, from $77 million as of August 31, 2012, to $59.5 million as of August 31, 2013.

Of course, it is impossible to predict where interest rates will go over the course of FY2014; still, rates do remain at historically low levels. This past year, rates increased by about 1% and that reduced our pension obligation by roughly $20 million. If interest rates trend slowly upward, as some expect, we may see similar results this year.

Do recall that the ABA’s pension obligation is only a measure of a cumulative future liability, and changes in this figure translate into required current cash obligations only over long periods. For example, changes associated with the August 31, 2013, measure of our unfunded pension liability will not affect any required contributions before September 2015. Moreover, future changes in interest rates and, of course, the performance of the investments dedicated to this liability, will affect our payment obligations.

OUR GREAT FINANCE TEAM

One of the greatest pleasures of serving as your Treasurer has been working with our excellent Financial Services staff. Since I reported to you last year, we’ve had several important changes.

First, my good friend and our former Chief Financial Officer Larry Gill has been promoted to Deputy Executive Director and Chief Revenue Officer, and given a lead responsibility for implementation of the non-dues revenue aspects of the myriad projects comprising ABAction! During his three-year stint as our CFO, Larry relied on his cool rationality, practicality, clarity, and humor in completely reforming Financial Services, and he built the best ABA financial team in anyone’s memory. The ABA is not losing Larry, but we will certainly miss his great leadership of Financial Services.

Second, our Controller Jerry Kiska, who joined the ABA only three months before Larry Gill, has been appointed Deputy Chief Financial Officer. Jerry’s accounting expertise and his mastery of the ABA’s byzantine finances has allowed him to bring a deep stability to Financial Services and develop a reputation for integrity and competence throughout the ABA. We’re counting on his continued strong leadership of our great Financial Services team.

Third, in early December, Executive Director Jack Rives, in consultation with a number of the volunteers most responsible for our finances, hired Bill Phelan as our new Chief Financial Officer. Bill comes to us directly from a 21-year career at Sears, most recently serving as Senior Vice President, Finance, of Sears Holdings Corporation. Those of us who have worked with him these last few months have been deeply impressed with his exceptionally quick grasp of our complex finances and politics and the clarity of his thinking and presentations. We’re expecting great things from Bill.

THANKS

By the time you read this report, my remaining time as your Treasurer will be measured in weeks. I am extremely happy that we will all have the services of Nick Casey of West Virginia as my successor. His ABA and professional background (among other things, he’s an honest-to-God CPA) and his intelligence and wit will serve us all well.

Serving you as Treasurer has been an honor, a privilege, immensely challenging, and great fun. Between these three years and one prior stint on the Board, I have learned a great deal about the ABA—good, bad, and otherwise. Given all that I have learned, I am fundamentally more optimistic than ever about the ABA’s future. Our Association’s prospects have never been better.

Thank you.

- ABA Treasurer Lucian T. Pera

Related Documents:

• Grant Thorton Audit Report for Fiscal Year Ending Aug. 31, 2013 (PDF)