April 8, 1895: Income tax ruled unconstitutitional

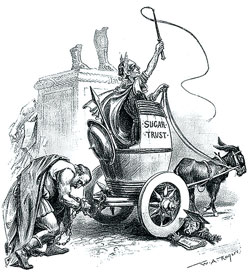

“Gorman’s Triumph—a humiliating spectacle.” Cartoon originally for Harper’s Weekly by W.A. Rogers.

At the end of the 19th century, with the burdens of debt and blood from the Civil War fast fading, a long-festering struggle over trade and tariffs was redefining Republicans and Democrats. Entrenched Republicans favored the protectionism of high tariffs on imported goods, while an increasing number of Democrats argued that freer trade would help reduce both the price of consumer goods and the influence of protected industries on the politics of the nation.

President Grover Cleveland, a Democrat who favored tariff reductions, had won and lost the presidency on the issue. When he regained the White House in 1893 for a second, nonconsecutive term, he was determined to reduce the nation’s massive tariff scheme, which averaged 49 percent on thousands of imports of products as diverse as raw sugar and corsets. But by the time the Wilson-Gorman Tariff Act of 1894 coursed its way through a Democrat-controlled Congress, it had been watered down with more than 600 special interest amendments. And a disheartened Cleveland, betrayed by his own party, allowed it to become law without his signature.

The new law, however, included a modest tax on annual incomes—including rents and dividends—of about 2 percent on $4,000 or more. But Massachusetts businessman Charles Pollock challenged the new tax. In Pollock v. Farmer’s Loan & Trust, the Supreme Court agreed. The 5-4 decision declared that a tax on any income derived from real or personal property was an unapportioned “direct tax” on the property itself, and therefore unconstitutional.

The decision meant, in effect, that wage earners could be taxed, but investors couldn’t—and the dissents were vigorous. Justice Edward Douglass White said the decision was based “on a long repudiated and rejected theory of the Constitution.” Justice Henry Billings Brown called it “nothing less than a surrender of the taxing power to the moneyed class.”

But despite the decision, the replacement of protective tariffs by an income tax became a popular plank in the Democratic Party platform, and in 1913 the passage of the 16th Amendment cemented the power of the federal government to collect taxes on incomes of any sort.