Judge Jed Rakoff’s stance on the SEC deals draws fire, praise--and change

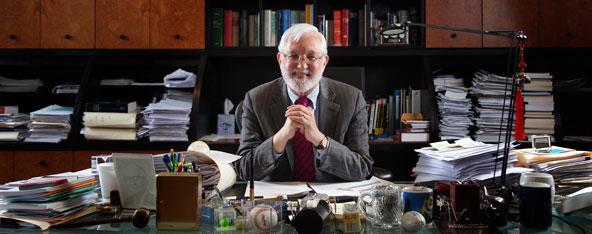

Photo of U.S. District Judge Jed Rakoff by Stringer/Reuters/Corbis.

Over lunch in New York City in 2009, U.S. District Judge Jed Rakoff took a dare. Then-executive assistant U.S. attorney Fred Virella complained that the prosecutor’s office had lost four games in a row in the Lawyers Co-Ed Softball League. Rakoff joked that it likely had to do with Virella being team manager.

A can-you-do-better retort led to a one-game stint for Rakoff as manager. And the judge cut an unusual figure on the field for that game against the Patterson Belknap Webb & Tyler law firm.

“I wore my robe because I figured that would intimidate the umpire and all the close calls would go my way,” Rakoff says with his characteristic growl of a laugh and a light slap of his palm on the see-through glass desk. His capacious, cluttered chambers provide plenty of testament to his being an inordinately serious baseball fan (of the Yankees, to be exact).

What was the rookie manager’s genius in an 11-1 victory? As Rakoff tells it, he had his team’s least experienced players, its two women, bat first and second. He figured the opposing pitcher would be more hittable at the outset before getting a feel for his best pitches.

Rakoff was not in his robe in the sixth inning when he made his only mistake: putting himself in the game. He stepped into the batter’s box wearing his business suit and dress shoes, with runners on base and an opportunity to drive in more runs. But he hit into a double play, falling ingloriously as his leather soles lost traction in the dash toward first base.

“At that point I noticed there were an awful lot of players from both sides taking pictures,” says Rakoff. “That concluded my career.”

In softball, that is.

Despite taking senior status in the federal Southern District of New York in 2010, to which he was nominated in 1995 by President Bill Clinton, Rakoff works more than the customary full time and is at the top of his game on the judicial bench. That he wore his robe in a softball game says something about how comfortable he is in it—and in his own skin.

That is probably best. Away from competitive frivolity in a city park, Rakoff has been engaged in figurative hardball at the highest levels in the years since the economy tanked. Setting himself up as an antagonist and sparking a rivalry between two branches of government, Rakoff has been a singular voice of backlash against what he sees as regulatory laziness in the face of financial misdeeds that helped grease our nation’s skid into a state of economic siege.

Rakoff has been noted (or notorious) in recent years for insisting that big financial institutions like Bank of America and Citigroup had some explaining to do before he’d sign off on settlement agreements they negotiated with the U.S. Securities and Exchange Commission.

As the judge sees it, the SEC has failed to pursue high-level individuals behind questionable dealings when it probably should have, and has let the corporations they ran get off easy with sweetheart settlements. Rakoff eventually came to believe that he and other judges have at times wielded rubber stamps rather than gavels.

So he balked at putting the force of his injunctive powers on agreements about which he had little substantive background information, and in which, by custom, the defendants neither admit nor deny wrongdoing. Some other federal judges around the country—in the borough of Brooklyn and the states of Colorado and Wisconsin—caught the bug and did the same.

The Constitution wasn’t exactly in crisis, but the questions asked of the SEC grew so sharp that the agency challenged Rakoff’s authority.

Citigroup complained that detailed admissions might make it an easy target for civil suits. The SEC argued that it has to work a great number of cases and knows best how to leverage its resources, and that judges should defer to its judgment as to what is “fair, adequate, reasonable and in the public interest”—the standard that judges apply in reviewing settlements.

As Rakoff has put it in his opinions and states in an interview—his speaking voice is a growl whether he’s being nasty or nice—he owes some but not total deference to the agency: “If I don’t know even the most basic facts, how the [he catches himself, then speaks more slowly to enunciate the next word] heck can I possibly determine that?”

When the judge declined to stay proceedings during an appeal of his ruling, the SEC took the nuclear option of filing a mandamus action against Rakoff with the 2nd U.S. Circuit Court of Appeals, based in New York City. The SEC and Citigroup say the judge overstepped his powers while stepping on those of the executive branch. The appellate court was expected to issue an opinion within weeks of the hearing in February. It had not done so at press time.

Photo of Judge Rakoff by Michael Lewis/Corbis Outline

FINANCIAL FRAUD EXPERTISE

It is widely known that in matters of financial fraud, the 70-year-old Rakoff, as his generation might put it, knows from Shinola. For seven years he was an assistant U.S. attorney in New York’s Southern District in the business and securities fraud prosecution unit, largely staffed with the best and brightest in the Manhattan office.

In 1980 he left for what then was considered an adventurous new practice area for big corporate firms, joining Mudge Rose Guthrie Alexander & Ferdon (now defunct) to run its white-collar criminal defense and civil racketeering group. He later moved his practice to Fried, Frank, Harris, Shriver & Jacobson.

Rakoff’s work at those firms included settlement agreements with the SEC, negotiating deals for corporate clients in civil matters that can look and feel like criminal ones, though the agency lacks criminal jurisdiction.

The symmetry was exquisite. Because federal prosecutors such as Rakoff had grown so aggressive in pursuing financial crimes, there suddenly was a lot of money to be made by corporate law firms in work that no longer seemed so unsavory. They now embraced their business clients’ criminal matters rather than refer them to smaller firms and lawyers specializing in criminal defense. And they could bill hours advising on how to avoid trouble.

“The big firms had always shied away from it because their other corporate clients might look down on them if they represented someone accused of wrongdoing,” says John “Rusty” Wing, a pioneer in doing exclusively criminal defense work at a big firm when he left as chief of the U.S. attorney’s financial fraud unit to join Weil, Gotshal & Manges in 1978. Rakoff succeeded his mentor, Wing, as head of the unit. They remain close.

And when the SEC and Citigroup ended up on the same page, the 2nd Circuit—at Rakoff’s suggestion—appointed Wing, now a partner at Lankler Siffert & Wohl in New York City, to represent the judge’s interests.

Rakoff wrote in his November 2011 refusal that before he lends his injunctive power, he and the public need to know some underlying details, “for otherwise the court becomes a mere handmaiden to a settlement privately negotiated on the basis of unknown facts, while the public is deprived of knowing the truth in a matter of obvious public importance.”

It was classic Rakoff. As Harvey Pitt, his friend and former partner at Fried Frank, puts it: “In addition to being brilliant, he’s very clever.”

Pitt, who also was SEC general counsel and later its chairman, filed an amicus brief supporting Rakoff, explaining why the agency he once ran is wrong and hammering several issues. One concerned the judge’s questions about the SEC’s contradictory stands on the severity of the wrongdoing. The SEC alleged, in a complaint filed simultaneously with the settlement, that Citigroup was negligent when it sold toxic mortgages to investors and then bet against them on the market, with investors losing $700 million and the bank making a $150 million profit. But, Pitt’s brief notes, the SEC also filed a related complaint against an individual, a midlevel Citigroup employee named Brian Stoker, alleging that his acts were knowing and intentional.

Even before presiding over Stoker’s trial, Rakoff lashed out at the proposed settlement, which called for a $285 million penalty but followed the SEC’s policy of no admission and no denial of culpability: “How can a securities fraud of this nature and magnitude be the result simply of negligence?”

In an unusual move, the Stoker jury sent out a note along with its verdict for the defendant. They urged regulators to aim higher.

A year earlier, the judge had also balked at an SEC settlement with Bank of America. Shareholders had been misled about the billions in bonuses paid out by Merrill Lynch just as it was being acquired by the bank. Rakoff called the proposed $33 million fine “half-baked justice.” It was upped to $150 million, and 35 pages of documentation were added. He still complained, but signed off on it.

CONNECTING DOTS

Rakoff often speaks at length in an interview, touching on a wide range of issues, listing his reasons and explaining them point by point, sometimes connecting the dots in one issue to those of another. At times he can seem to meander, but then ties things together neatly as he discusses the rapid development of law as a business and the resulting harm to the profession, which in turn helped facilitate the economic crisis. And he explains how changes in the politics and policies of enforcement and regulation have failed the role of criminal law as applied morality.

He sometimes comes across as a historian, which he almost was. The Philadelphia native’s father was a gynecologist and his mother a high school English teacher. He got his bachelor’s degree in English at Swarthmore College, where he became editor of the school newspaper when only a sophomore, and later was student council president. But at Oxford’s Balliol College, before deciding to go to Harvard Law School, he studied history.

Rakoff can easily become animated in conversation—through verve, not gesturing—and despite the white hair and beard, at close range he looks much younger than his 70 years. As a judge, he has been known for bold strokes. In 2002 he ruled the death penalty is unconstitutional because of the probability of innocent people being executed. The 2nd Circuit reversed him, and he believes his challenge ended any chance of him being promoted to that court. And in 2006 he ordered the U.S. Department of Defense to release the names of detainees at Guantanamo, scoffing at the government’s argument that it would violate the prisoners’ privacy rights. The 2nd Circuit reversed that ruling in 2008.

Robert Morgenthau, 94, who while serving as the Southern District U.S. attorney in the 1960s created the financial fraud unit Rakoff later joined, used the word independent four times in describing his friend and semiregular lunch partner.

“He doesn’t mind going against the flow when he thinks it’s wrong,” Morgenthau says. “He’s creative and independent and doesn’t take things at face value.”

Tough as he is, Rakoff can be a relatively light sentencer, though he can be an outlier on the other end of the spectrum.

In 2011, U.S. District Judge Richard Howell sentenced hedge-fund billionaire Raj Rajaratnam to a substantial 11 years in prison. Rakoff followed up with a hefty civil fine, ordering Rajaratnam to pay a $92.8 million penalty to the SEC, the biggest-ever fine for insider trading. But a year later Rakoff sentenced the man who provided those tips, Rajat Gupta, who was a Goldman Sachs director, to just two years in prison. Rakoff went well below the sentencing guidelines recommendation of 8 to 10 years, citing Gupta’s long-running, significant and genuine philanthropic efforts.

Rakoff is one of the more vocal critics of the guidelines, which he has savaged more than once in sentencing memoranda.

“Perhaps the most fundamental flaw is the notion that the complexity of human character and conduct can be rationally reduced to some arithmetic formula,” he says. In March, in his keynote address at the ABA’s annual National Institute on White-Collar Crime, Rakoff declared: “Basically, my modest proposal is that they should be scrapped in their entirety and in their place there should be a nonarithmetic, multifactor test.”

In a May speech at the Loyola University Chicago School of Law, Rakoff explained that judges and juries can usually figure out whether a defendant in a securities case engaged in intentional fraud. He used the example of being passed on an expressway by a driver going 90 miles an hour. Rakoff and others on the road were driving 60 to 65 mph, which meant the one driver was arguably reckless. The speed limit was 50 mph, so they all were disobeying the law, but in the backs of their minds they were collectively creating a slightly increased risk. They had a “peer group view of what is appropriate in that circumstance.”

Rakoff eventually comes to a red light and gets some satisfaction that he’s pulling up beside the guy who had been doing 90. He looks over to see who is at the wheel. If it’s a teenager, the recklessness might be ascribed to a lack of both experience and impulse control. If it’s a drunk, that’s a different kind of culpability. But if it turns out to be a 40-year-old adult whose desire to get somewhere in a hurry “overcame his knowledge that he was creating a risk for everyone involved, that is reckless driving.”

In securities fraud cases, Rakoff continued in his speech, “recklessness has remained stubbornly ill-defined and in most decisions awkwardly conjoined to actual intent.” One result is that “for me it has been very striking and surprising that there have not been more criminal prosecutions of persons who, in some sense, could have been held responsible for the economic crisis that still permeates today.”

Recklessness, he argued, has to be conjoined with moral culpability. He used the Stoker case as an example: an SEC civil action that felt like a criminal trial. Stoker’s lawyer showed the jury a blowup of a Where’s Waldo? children’s book cover, asking them where Stoker was in that huge crowd of people engaged in the same activity.

“So the jury was of the view that some wrong had been perpetrated,” Rakoff said, “yet they found it very difficult to identify, in a morally culpable way, the guilty party in the transaction.”

MANY FACTORS OF FINANCIAL CRISIS

The judge’s view of significant financial crimes of recent years is more through a prism than a lens, highlighting an array of factors that had come together in disastrous form.

The 1999 repeal of the Glass-Steagall Act, which had kept commercial banks from engaging in investment banking, he thinks was a major mistake in a broader bipartisan effort at deregulation. (One could say it sent traditionally conservative bankers to the casinos.) Then everyone from government, including regulators, down through various industries pushed home ownership as an all-important goal, creating a bandwagon to boom and then bust.

And Rakoff is aware of complexities, pointing out that, whatever mistakes or wrongdoing by Bank of America in its acquisition of Merrill Lynch, the deal was an important piece in the government’s bailout for solving the financial crisis.

“The agreement was hammered out over a Labor Day weekend because the government was pushing Bank of America,” Rakoff explains. “[The bank] wanted it, but in the normal course the deal would be over many weeks with more due diligence—but the government said, ‘You gotta do it now,’ to save the economy or save the brokerage role.”

In a different situation, there might have been grist for a criminal case. But with the government involved at both ends of the deal, Rakoff says, “it makes it much harder for a prosecutor to bring a criminal case. The defendant could say, ‘I did what my country told me to do.’ ”

And looming in the background, Rakoff points out, is the fateful 2001 prosecution of now-defunct Arthur Andersen, once one of the Big Five accounting firms, which had to surrender its license for certified public accounting after being convicted criminally for its auditing of the infamous Enron Corp.

Connecting dots from another of his peeves, Rakoff believes the Enron fiasco resulted in part from companies being “smart economically” by significantly increasing the size of their in-house law groups. With more work done by their own lawyers, they tended to rely on outside law firms only for specialty work, moving away from relationships in which law firms and clients know each other well. It largely ended Dutch-uncle type advice from wise and wizened lawyers who could and would say no when a proposed venture seemed too risky.

Enron had 10 or more law firms doing various specialty work, Rakoff explains. Eventually, two top Enron officials were convicted of securities fraud and imprisoned, and 16 other employees pleaded guilty.

“I don’t think you’d find more than a tiny handful of lawyers today who would ever say [no] to a client,” Rakoff says.

While Enron entered bankruptcy and disintegrated, the U.S. Supreme Court reversed Arthur Andersen’s felony conviction in 2005. But the firm’s name was too tarnished to resume business. Rakoff believes destruction of the accounting giant has caused enforcement authorities, including the SEC, to be overly cautious about harming businesses in an already weak economy.

Says Columbia Law School professor John Coffee, who for years has taught an evening class with Rakoff: “Since Arthur Andersen, the government hasn’t indicted many public corporations—and particularly not financial institutions. Plenty have been eligible for indictment. I think enforcement punch has been pulled on many occasions.”

After a while, Rakoff’s anecdotes, observations and analyses begin coming together like constellations in a clearly patterned universe.

It is one in which personal responsibility is paramount, and where the words truth and morality echo. That applies in everything from sentencing criminals to fileting lawyers who come to court unprepared—and, of course, judicial oversight of settlement agreements that seek his injunctive relief.

Rakoff pulled together much of it in his November 2011 cri de coeur—or perhaps j’accuse—writing that assenting to the approval of the Citibank settlement would “serve no legal or moral purpose” in a case that “touches on the transparency of financial markets whose gyrations have so depressed our economy and debilitated our lives.” In a flourish, he noted “an overriding public interest in knowing the truth. In much of the world, propaganda reigns, and truth is confined to secretive, fearful whispers.”

Photo of Judge Rakoff by Stringer/Reuters/Corbis.

WORKAHOLIC WAYS

Few, if any, lawyers are willing to speak negatively on the record about Rakoff. One complains, not for attribution, that the judge can be a workaholic and leave litigators no choice but to do the same on Rakoff’s schedule. This lawyer mentions having to prepare for and be in court the day before a major holiday, when many might be traveling.

“But it’s hard to be upset with a judge who puts in the time, pushes the case and gives it a fair amount of attention,” the lawyer says. “So it’s hard to complain about him.”

“It’s a boon for clerks,” says Brianne Gorod, who worked for Rakoff in 2005 before moving on to clerk for Judge Robert Katzmann on the 2nd Circuit (Rakoff and Katzmann share clerks so often as to be a judicial tag team) and then for Supreme Court Justice Stephen G. Breyer. “With Judge Rakoff, you generally spend more time in court than with many district judges these days, and it really speaks to the way he sees the role of a judge.

“He’s just so smart, and you sit in the courtroom and watch how quickly he processes the lawyers’ arguments, how sharp his questions are, how he can synthesize so many different things going on in the courtroom at once,” says Gorod, appellate counsel at the Constitutional Accountability Center, a progressive think tank and law group in Washington, D.C. Rakoff and Katzmann co-officiated at her wedding in Washington last year.

During one exchange with an SEC lawyer concerning how much deference a judge should give the agency, Rakoff shot back: “An interesting position. I’m supposed to exercise my power but not my judgment.”

That dealt with one aspect of the judge’s standard of review from which he has pulled back in the 2nd Circuit squabble: whether the settlement is “in the public interest.”

“There’s a debate over whether I’m to determine that,” he says now. But he has remained all in on his mandate to consider whether a settlement is fair, reasonable and adequate. Those standards were established in a 1982 decision in the Western District of New York—U.S. v. Hooker Chemicals & Plastics Corp.—and affirmed by the 2nd Circuit in 1985.

MAKING CASES

Back in the 1970s the SEC’s enforcement chief in D.C., Stanley Sporkin, sometimes would call on Wing and Rakoff at the U.S. attorney’s office in New York to handle cases that begged for criminal prosecution. Rakoff recalls speaking on the phone almost weekly with Sporkin.

“His instincts were so good, he was almost never wrong,” says Rakoff. “His philosophy was totally, ‘If the facts are there, go get ’em with everything ya got.’ ”

Rakoff recalls that in his New York social circles back then, mentioning Sporkin tended to spark anger: “He was a pariah … because he went right to the truth. He didn’t let any extraneous consideration deter him. When he found evidence of misconduct, he never held back.”

Sporkin is a legend. Besides heading SEC enforcement, he has been the CIA’s general counsel, a Weil Gotshal partner and a federal district judge. He believes his friend Rakoff is wrong to refuse the SEC settlements. He does, however, agree with much or all of Rakoff’s reasoning, such as the need for individual responsibility, especially for deterrence and preventing recidivism.

“He’s absolutely right,” Sporkin says, repeating the phrase several times as he listens to a list of Rakoff’s concerns and approaches. “But how far you can go is another question,” Sporkin says. “This is a philosophical difference. Theoretically he’s right on a lot of this, but practicality is the issue here. How does a government agency get the most bang for its buck? And it’s important to correct the conduct quickly, to cut out the cancer before it spreads to others in the same industry.”

Sporkin, too, knows from Shinola and has his own mandamus experience. He refused to sign off on a consent decree in the U.S. v. Microsoft case in 1995. He had looked over the Antitrust Division’s shoulder concerning an issue that wasn’t in the complaint, and he demanded it be addressed. The D.C. Circuit Court of Appeals remanded the case to another judge for settlement.

“It’s a tough issue deciding the extent to which Judge Rakoff shouldn’t be telling the commission what to do,” says Sporkin, “but neither should anyone be telling a judge what he ought to do.”

In April, the SEC got a new boss when Mary Jo White was sworn in as chairman. The former U.S. attorney for New York’s Southern District indicated that enforcement will toughen. And in June the agency’s heads of enforcement sent staff a memo announcing that, in some cases, they will forgo the no-admit-no-deny policy in settlements and require “admission of allegations in our complaint or other acknowledgement of the alleged misconduct as part of any settlement.”

The announcement came after the 2nd Circuit had gone months beyond the expected timing for a decision on the mandamus action.

The SEC said it will begin requiring admissions of culpability in cases involving large numbers of investors or the potential for serious harm to the market, when there is “egregious intentional misconduct” or when investigations are unlawfully obstructed. Many see that as still vague, and how it plays out remains to be seen. But it also is seen as vindication for Rakoff. Asked about that, White has flatly denied it.

“It would be silly to think that his concerns didn’t play a role,” says Pitt, the agency’s chairman in the early 2000s. “To say it wasn’t the principal role or whatever, that’s fine, but it’s clear to me his concerns definitely had something to do with a shift in policy.”

Rakoff and Sporkin have debated settlement requirements on panels. Some of the enforcement issues Rakoff complains about, he politely and perhaps half-humorously points out, began on Sporkin’s watch at the SEC. Says Rakoff: “I can understand why he finds it difficult to come over totally to my side, but I’m working on him.”

Correction

Because of a reporting error, the sentencing of Raj Rajaratnam was attributed to the wrong judge. U.S. District Judge Richard Holwell oversaw Rajaratnam’s criminal trial and imposed his 11-year sentence. Rakoff handled the civil penalty to the SEC.The ABA Journal regrets the error.