Final version of federal tax law reflects ABA victories on key issues

Illustration by Sara Wadford; Shutterstock.

The tax overhaul package signed into law in late December by President Donald Trump includes key provisions advocated by the ABA that benefit lawyers and law firms.

The Tax Cuts and Jobs Act of 2017 marked the first major reform of the nation’s tax system in more than 30 years. The sweeping new law lowers the corporate tax rate from 35 to 21 percent and cuts income tax rates for most individuals while also eliminating or reducing many existing corporate and individual deductions.

The ABA was particularly interested in the passage of the following provisions:

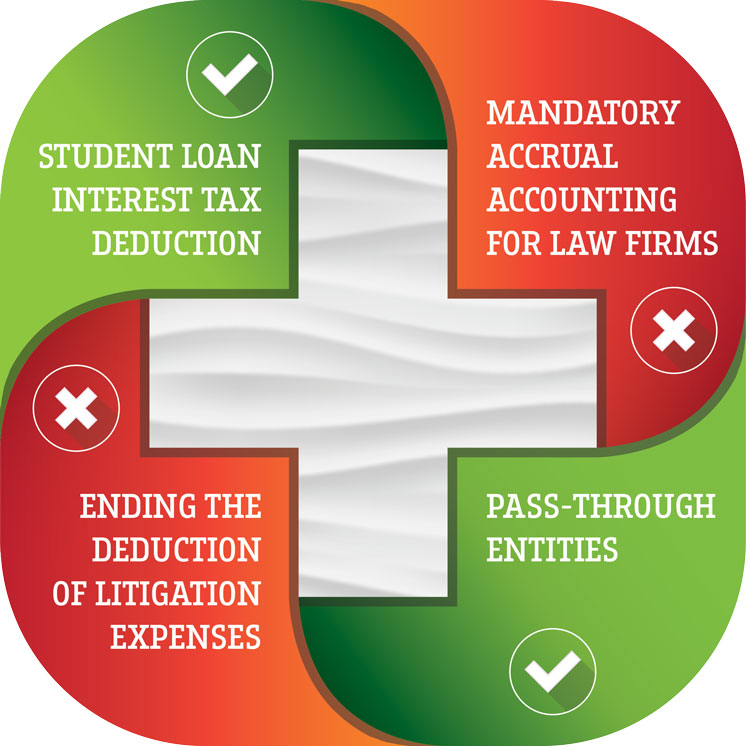

Pass-through entities. These entities—businesses such as sole proprietorships, partnerships, LLCs and S corporations—do not pay federal income tax directly but instead pass profits through to the owners of the businesses who report that income on their individual tax returns. Under the new law, individual owners of pass-through entities—including law firms and other professional services businesses—may deduct 20 percent of the “qualified business income” they receive from the entities.

The deduction phases out, however, for owners of most professional services businesses (including law firms) that earn more than $315,000 for married taxpayers filing jointly or $157,000 for single taxpayers. Nevertheless, many high-income law firm partners may still receive substantial tax reductions because the law also lowers the top individual income tax rate from 39.6 to 37 percent. It also increases income thresholds for taxpayers in the highest income brackets.

The new tax law follows the Senate approach for pass-through entities that the ABA supported in a Dec. 13 letter to the House-Senate conferees crafting the final version of the legislation. In her correspondence to the conferees, ABA President Hilarie Bass urged them to apply the same deduction to all pass-through entities—including law firms and other professional services businesses—on an equal, nondiscriminatory basis to create “a more level playing field” for all such business entities.

Student loan interest tax deduction. Congress decided to preserve the existing student loan interest deduction in the final legislation after the ABA and other groups emphasized the importance of the deduction to students who wish to enter public service as a career.

“The deduction of interest on law school loans helps recent graduates to accept lower-paying public service jobs that they might not otherwise be able to afford,” Thomas M. Susman, ABA Governmental Affairs Office director, wrote to the leaders of the House Ways and Means Committee and the Senate Finance Committee.

ON THE CUTTING ROOM FLOOR

The legislation is also notable for the measures it did not contain, including:

Mandatory accrual accounting for law firms. The ABA opposed such provisions, previously under consideration, because they would have required many law firms to switch from cash to accrual accounting and, as a result, pay taxes on their work in progress, accounts receivables and other “phantom income” long before it is received from clients.

The ABA worked with 30 state and local bar associations, dozens of law firms and other coalition allies for over four years to protect the legal profession from the severe financial hardships that would have resulted had these provisions been enacted.

Ending the deduction of litigation expenses. Consistent with ABA policy opposing legislation requiring law firms to switch from cash to accrual accounting, Congress dropped a provision contained in an earlier version of the bill that would have eliminated the current ability of plaintiffs lawyers with contingency fee cases in the 9th U.S. Circuit Court of Appeals at San Francisco to deduct their litigation-related expenses at the time they are incurred.

Bass celebrated the ABA achievements in an email to ABA members.

“The American Bar Association won hard-fought victories on key issues affecting the legal profession,” she wrote, and “while not all ABA recommendations were incorporated into the final legislation, these issues were favorable for lawyers and law firms.”

This report is written by the ABA Governmental Affairs Office and discusses advocacy efforts relating to issues being addressed by Congress and the executive branch of the federal government. Rhonda McMillion is editor of

This article was published in the March 2018 issue of the ABA Journal with the title “Less Taxing: Final version of federal legislation reflects ABA victories on key issues.”