Work on Your Retirement Plans: Choices Depend on Firm Size and Income

The first step toward retirement security is this: “Adopt saving as a part of your lifestyle,” says Jay Foonberg, who built a successful Beverly Hills, Calif., practice spanning 50 years. “Save first, spend what’s left, and you’ll always have money.”

Retirement benefits expert Bob West with Haynes Benefits law firm in Lee’s Summit, Mo., concurs. “Don’t jeopardize your cash flow—but, whatever you can save, do it. For every dollar put in a retirement account, you can defer up to 20-30 percent of taxes.”

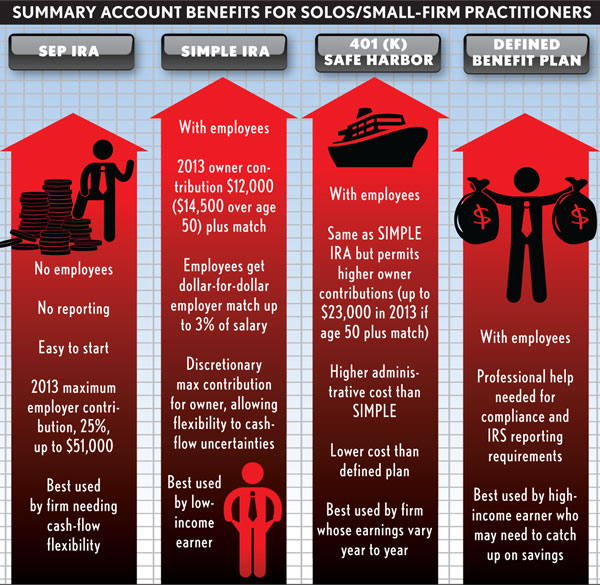

And where should you put those savings? “If you have no employees, there’s little reason to have anything other than a simplified employee pension,” West says. “The SEP is an IRA plan that isn’t subject to many of the onerous rules of ERISA, and enables contributions at the lesser of 25 percent of compensation” or a 2013 maximum of $51,000.

A SEP accommodates cash-flow uncertainties, West says: “For example, a contingency practice where you might have $1,000 to put in it one year, and then a payoff comes in and you can put in $50,000 the next year.” West advises against single-participant 401(k)s, nicknamed Solo 401(k), as having “no value to it over a SEP for most solos without employees.” Still, tax-free loans and a $5,500 catch-up maximum for those over 50 must be weighed against the Solo 401(k)’s administrative burdens and fees.

A Safe Harbor 401(k), or a Savings Incentive Match Plan for Employees (known as a SIMPLE IRA), is pref-erable to a SEP when employees are involved. “Whatever percentage of compensation an employer contributes to a SEP must also be contributed by the employer on the employees,” says West. A SIMPLE IRA only requires a matching dollar-for-dollar contribution up to 3 percent of an employee’s compensation, and the owner’s elective contribution is discretionary.

NOT SO SIMPLE

“However,” West says, “SIMPLE is not for a solo who wants to contribute more than $12,000 ($14,500 if over age 50), plus the 3 percent matching contribution.” In that case, West finds a Safe Harbor matching 401(k) attractive. Owners can contribute up to $17,500, or $23,000 if they are over 50, in 2013, plus the match. To max employer contributions at $51,000, ask your financial adviser about a cross-tested profit-sharing option. Defined benefit plans are helpful to allow savers to catch up when consistently high income is certain. “Potentially problematic is the funding requirement. If there’s a possibility of future cash-flow problems, or a work slowdown, avoid a defined plan,” West says. “When you can’t make the mandatory annual contributions, IRS problems result.”

But if selling the practice is your only retirement plan, Venice, Calif., attorney Ed Poll, who specializes in law firm practice management, advises you to reconsider. “I believe that any practice is salable,” Poll says. “The question is, at what price? The economy, demographics, others with the same specialty in your area: These are factors that affect the price and value of your practice. These factors are also unknown until an attorney is ready to sell.” As Poll puts it, “The law practice is an important piece of the retirement pie, but should not be the only piece.”

Chart by Brenan Sharp

Susan A. Berson is a partner with the Banking & Tax Law Group of Leawood, Kan.