Monetizing your investment in legal tech

Jaap Bosman

On a daily basis, the legal world is flooded with news about legal tech. Not a week goes by without one or the other law firm announcing a fancy new tech initiative. Nine out of 10 newsletters contain an article on legal tech, and in every major city around the world, there is a constant stream of seminars on the topic. Legal tech seems to be omnipresent, no escaping possible.

All this buzz creates an uneasy sense of nervousness among law firms. We get questions from clients on this topic all the time. Typically, there is the fear of losing out. An atmosphere has been created in which it seems that all other law firms are investing in legal tech, and that when not keeping up with technology, a law firm might go out of business. Will there still be a future for law firms that do not use fancy technology? In this article I will take a look at legal technology from an investor perspective. So, if I had a law firm, why and when would I invest in legal technology?

WHAT PROBLEM AM I TRYING TO SOLVE?

Time-based billing has been the de facto standard in the legal world for decades. Notwithstanding the fact that this system is flawed, it is favored by both law firms and their clients. In a situation where clients are paying the lawyers by the hour, it is in the clear interest of the client that the process is as efficient as it can be. Lawyers should not use more time than needed.

In a way, just like all other businesses, law firms have a long track record of integrating new technology to make the workflow more efficient. A couple of decades ago, there would be a small army of secretaries and typewriters that since have been replaced by Microsoft Word. Lawyers used to dictate memos; today it will be hard to find even a partner who does not sit behind a keyboard. Incorporating this kind of office technology has immensely increased the capacity of lawyers. The work volume that can be handled in terms of output has increased. At the same time, cost for secretaries (and their workspace) went down.

Today the issue is not the optimization of office procedures or workflows. The discussion is pivoting toward the output side. Should we use technology to, in part, replace lawyers? In order to answer this question, we need to dissect the legal product as we know it. The process of producing a legal product, whether it be an agreement or litigation, invariably consists of two components: creation and production. Creation being the fruit of the brainpower, the skills and the experience of the lawyer, and production being everything that needs to be done in order to make it happen. In my new book, Data and Dialogue: A Relationship Redefined, I will elaborate in more detail on this topic.

What we see in the market is that law firm clients are increasingly reluctant to pay a lot of money for production. This totally makes sense, since all the value is in the creation. We regularly hear law firms complaining that their clients only want partner time. This reflects the theory. As long as there is time-based billing, law firms will be under pressure to limit the costs for production. This is exactly where technology could potentially help. It, however, does not necessary mean that it is sensible to heavily invest in legal tech.

WHAT ABOUT RETURN ON INVESTMENT?

Most of the technological progress that law firms have made through the past few decades has led to an increased capacity and a reduction of costs at the same time. From an investment perspective this is a no-brainer. Today, things are fundamentally different. Investment in legal technology that replaces part of what lawyers are doing could have a strong eroding effect on profitability. Let’s examine this in more detail.

Assume we have a law firm and we invest $1 million in fancy legal technology. The $1 million investment will cover the purchase and implementation of the software. Typically, there will also be annual recurring costs for software licenses, updates, trained staff, data entry and data cleaning. For the sake of simplicity, we will assume only the one-time fixed investment of $1 million.

The first question will be how the investment will help us make money. For this there are two options: The investment either lowers the costs of production at the present volume or the volume of work needs to increase thanks to the investment. Lowering the costs at the same volume of work would mean that we must make some lawyers redundant. If we want to invest $1 million, make a return on investment and don’t want to fire lawyers, we need to increase the volume of work.

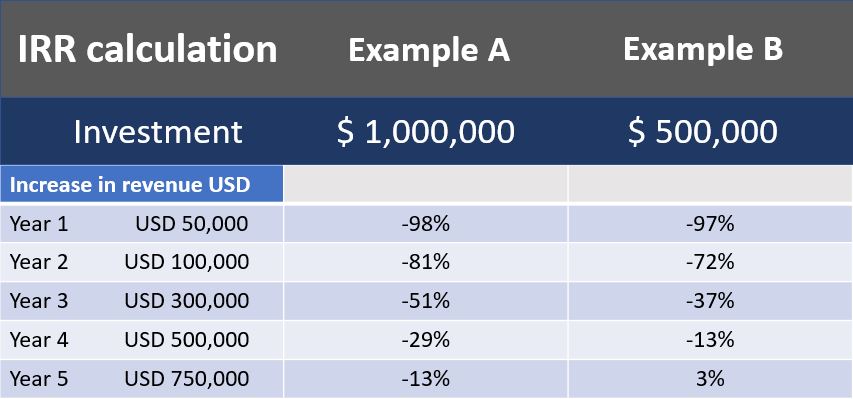

A method we use to see if an investment is viable is through calculating the IRR. The Internal Rate of Return is a metric used in capital budgeting to estimate the profitability of potential investments. IRR is a common method businesses and investors use to calculate if an investment makes sense.

The table above shows two situations. In example A we invest $1 million in legal technology. In example B the investment is $500,000. The column on the left shows the yearly increase in revenue the investment in technology will bring.

As it will take time to get used to the technology and apply it in client matters, this number will increase over the years. So, in this example we make $750,000 extra in year 5 thanks to the technology investment.

Please keep in mind the numbers are for illustration purpose only and will be different in your situation. For calculating IRR we assume a profit margin of 33 percent (ALM 200 average).

It is not necessary to completely understand the model or the way IRR is calculated. What is important is that the model shows that it is not easy to make profit on an investment in technology, even if the investment directly helps grow the revenue of the firm.

The point is that law firms should always look at the potential for return on investment when deciding on legal technology. Any law firm should make a realistic business plan that will provide a financial rationale before investing in legal technology. In some situations, there absolutely is a strong business case to be made. More often than not, law firms invest because they believe everyone else is doing it and they fear being left behind. The investment is made without any strategy on how to monetize the investment. In general, that is not a smart move.

Jaap Bosman is a leading strategy consultant, investor and one of the founding partners of TGO Consulting, a boutique consultancy focusing on the legal sector operating from New York, the Hague and Hong Kong. In 2015 he published Death of a Law Firm. Bosman is a regular speaker on the future of the legal sector.

ABAJournal.com is accepting queries for original, thoughtful, nonpromotional articles and commentary by unpaid contributors to run in the Your Voice section. Details and submission guidelines are posted at “Your Submissions, Your Voice.”

Your Voice submissions

The ABA Journal wants to host and facilitate conversations among lawyers about their profession. We are now accepting thoughtful, non-promotional articles and commentary by unpaid contributors.