Road to retirement: Ways to make retirement anything but resignation

Do you have all your ducks in a row? Illustration by Shane Rebenschied.

Deanell Reece Tacha has the characteristic enthusiasm of a 3L: “I’m in my third year here and I love it. It’s very interesting and challenging. I think there is something to not just letting yourself sit by. There is a commonsense fact that when you challenge yourself, test yourself in a new place, challenge your analytical and interpersonal skills, they sharpen.”

But Tacha’s not a law student. She’s the 67-year-old dean of Pepperdine Law School.

“I can see the beach, but I haven’t had time to go there,” Tacha says of her work schedule. “It’s very different from being a judge, where you control your own time. ”

Formerly a judge on the 10th U.S. Circuit Court of Appeals at Denver, Tacha rejected fading into the judicial woodwork of the traditional senior status route, retiring so as to take on a new career.

“I’m so fortunate to have been on the bench for 25 years, but I’ve always known that I needed a new challenge to keep myself energized.”

She started the new job when she was 65 years old. “That was my first year here. I traveled to 22 cities learning new names, faces and goals of employers, alumni, donors and educators—all this when I wasn’t visiting with students about their needs.”

Tacha describes herself and her husband, John, as “both people who feel like we’re better when we’re engaged.” And she doesn’t think they are unusual.

January 2014

- • Road to retirement: Ways to make retirement anything but resignation

- • How lawyers can dig themselves out of debt and plan for a future (podcast with transcript)

February 2014

March 2014

April 2014

WEBINAR

Download a webinar on retirement issues for lawyers, recorded on March 26, 2014. (Windows Media file)

“Take the man who was checking me in at the airport,” she says, “I said to him, ‘You have as much white hair on the top of your head as I do,’ when I saw him lift my heavy bags. He replied, ‘It keeps me in shape and I don’t have to go to the gym.’ He’s active.”

“Reflecting a bit on the women’s movement 30 years ago,” Tacha says, “I’d say that we have a situation now where many seniors feel disenfranchised. They may not have the same energy level they once did; but with respect to lawyers, they have an experience level and intellectual contribution to make. It’s just [that] the uncertainties of the legal market are very disconcerting.”

Photo of Deanell Reece Tacha by Tony Avelar.

Mary Beth Blake’s approach to work matches Tacha’s. “I’m still having fun,” says Blake, age 62, a Kansas City, Mo.-based senior partner in Polsinelli’s health care law practice.

Law school sweethearts, Blake and husband Mike have similarities that also complement their differences. “Neither one of us are the types to lounge around in a retirement community,” she says. “But my practice kicked into high gear when he decided to retire from his construction law work.”

“The fast-paced changes to our health care laws bring intellectually interesting work, and I still receive great satisfaction helping my clients cope with the new requirements,” Blake says. “My husband refocused on issues that are of interest to him, … including design and construction work and developing new computer programs. We like traveling and visiting with our kids and grandkids, but we also both need intellectual pursuits to be happy.”

The Tachas and Blakes are among the baby boomers changing the way society views traditional retirement. Whatever your personal definition of retirement is, everyone shares the same goal: a comfortable retirement life. Whatever your age, managing retirement savings is as important as managing your career in a transitioning legal market. To the extent that shrinking incomes, increased stresses and relationship obligations are blurring your retirement vision, the good news is this article is the first of a series focusing on the steps you can take to sharpen it.

Should you be among the 40 percent surveyed by J.P. Morgan Asset Management whose savings plan is to “wing it,” it’s not too late to plan. Deciding how to handle your finances, your health and your life events will determine how, when and where your retirement days are spent.

Mary Beth Blake: “The fast-paced changes to our health care laws bring intellectually interesting work, and I still receive great satisfaction helping my clients cope with the new requirements.” Photo by Chuck France.

STEPS ON THE PATH

Understanding that neither age nor law school graduation dictate retirement, what follows is a chronological listing of the basics for professionals to chart a comfortable retirement path as they advance in the profession.

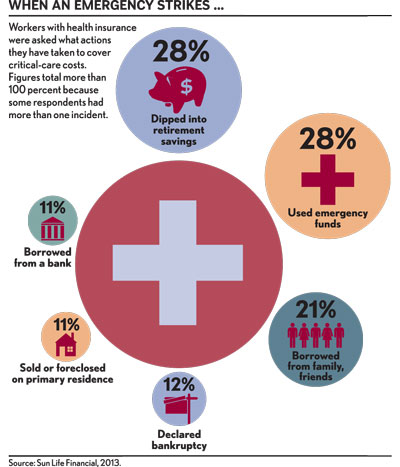

The first requirements are true for any age. An emergency fund helps you to financially handle unforeseen circumstances. “We’re navigating a challenging legal culture,” Tacha says. “Both legal education and the profession itself are still going through changes.” Whether an accident or layoff causes a missed paycheck, at least three months (but preferably 12 months) of living expenses should be saved to minimize financial harm.

And a budget tailored to achieving your short-term and long-term goals is a must-have for everyone. Financial industry standards recommend allocating 10 percent of your salary to retirement savings. But goals and income differ among attorneys, just as skills and expertise do.

Ages 25-35: “I had a whole new schedule with a new set of priorities,” says Jerry Negrete, an Austin, Texas-based second-year associate at Paine, Tarwater and Bickers. Entering what could be the busiest time of a lawyer’s life, Negrete found a way to juggle job responsibilities with retirement savings. “The No. 1 thing that has helped me was to talk to a professional who helped me prioritize everything—because anyone can make a budget, but if it doesn’t contain the right priorities, you’re not going to get what you’re working so hard toward.”

A newlywed, Negrete and her husband, Diego, discussed finances before walking down the aisle. “I have student debt. Diego already had a home mortgage, so we talked about how to handle those,” says Negrete. “I started a Roth [IRA]. Then, when I became eligible, I maxed out on the 401(k) option at work.”

IRAs and 401(k)s are appealing for tax and retirement reasons. Get a tax deduction now for a traditional IRA contribution. Roth IRA contributions are included in taxable income now, but future withdrawals are tax-free. Make 401(k) contributions when eligible.

If you share Negrete’s burden of student debt, budget a threefold goal:

1.) Establish your emergency fund.

2.) Pay off your debt, especially high-interest credit cards.

3.) Make retirement deposits.

Jerry Negrete: “I started a Roth [IRA]. Then, when I became eligible, I maxed out on the 401(k) option at work.” Photo by Josh Huskin.

For job hunters or new firm owners, student loan deferment and credit card collection renegotiations take precedence until you’re earning income.

And consider the My Savings Machine calculator at Bills.com for estimates on how small sacrifices can save money over time.

36-55: After about 10 years of practice, income potential evolves. A home and acquiring possessions may become the goals. A new job trajectory may also become a reality.

“My transition was in the summer of 1999, which was a unique time because of the dot-com bubble,” says David Jacoby of Seattle. “I was 35, single in New York, had worked for a Wall Street firm, and then moved back home because of the opportunity to go in-house for a dot-com startup. Ultimately, that company came and went with the implosion of dot-coms in 2001.

“While the implosion was terrible at the time, the skills I learned and the connections—working with high-tech companies—eventually helped me transition into where I am now.”

Today, Jacoby is managing director of Sales Readiness Group in Mercer Island, Wash. “I’m a lawyer but using my skills in a different way to help companies maximize their sales potential.”

David Jacoby: “Today, our portfolio is all about diversification and avoiding excessive risk.” Photo by Chris Joseph Taylor.

When switching jobs, consider moving your 401(k) plan from the former employer into a rollover IRA offering lower-cost mutual fund options. Going solo—or building small-firm partnerships—offers various plan options.

Periodically track your level of savings. Free online tools from AARP, Bankrate .com and the Center for Retirement Research at Boston College help you to estimate retirement expenses and projected savings rates. Reduce expenses and boost savings if calculations reveal gaps. And avoid “doing an Enron.”

“When I got married in 1999, my portfolio was not diversified at all,” says Jacoby. “It was 100 percent in high-flying dot-com stocks. My wife, Beth, told me: ‘It’s going to drop. We should sell it and buy a house.’ I was skeptical, but I followed her advice. Then, the bubble burst on the dot-com world and I was very glad I listened to her! Today, our portfolio is all about diversification and avoiding excessive risk.”

Peak earning years merit increasing retirement deposits. But when income decreases, reduce expenses before sacrificing retirement deposits.

When Bernard J. Knight Jr. decided to leave government service for private practice, he met with a certified financial planner to help make decisions about his anticipated 2014 McDermott Will & Emery compensation package. “I started thinking about how I wanted to retire. I wanted suggestions on how best to direct my income, and when to pay off my mortgage,” Knight says. “Increasing retirement contributions was a no-brainer.”

Avoiding the trap of letting debt grow in proportion to his partner draw, Knight focuses on his practice. “I’m more motivated by interesting work than possessions,” he says. “So it’s not a difficult choice to deposit to retirement savings instead of, say, overleveraging with debt for big items because I have a bigger salary.”

Graphics by Adam Weiskind

Budget to take advantage of “catch-up” contributions. Increased contributions are allowed to retirement accounts for those 50 and older. And with managed accounts and brokers, remember Jacoby’s advice: “Diversification, keeping a long-term perspective and low fees are the key priorities for managing my portfolio.”

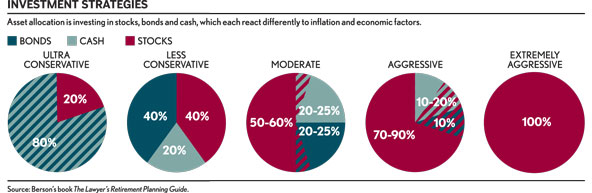

Diversification means where and how to invest your money best to minimize risk of loss. Inflation and taxes can also take a bite out of your savings.

“Research shows that most investment returns are attributable to two factors: asset allocation (how much risk you want to assume) and how low you keep the fees,” Jacoby says. Asset allocation is investing in assets of stocks, bonds and cash that each react differently to inflation and other economic factors.

56-70s: Continue your catch-up contributions. Within five years of retirement, test the budget you anticipate living on in retirement. Calculate Social Security benefits at the AARP website. Research income-stream options for retirement such as inflation-adjusted annuities, diversified with a money market account offering systematic withdrawals.

Health issues may demand more time and money. “For attorneys, I think our health is really one of those things you don’t think about until something hits you or a family member,” says Blake. “Determining what your level of coverage is for insurance is really more important than it is sometimes thought to be. Take advantage of any screening and coaching services provided by your health insurance provider.”

Retired: Stay on budget. Retiree couples lacking a nest egg to cover a minimum of $227,000 in medical expenses should use a portion of their Social Security checks for unreimbursed expenses.

Charles Wheeler: “After my dilemma, I’d say stay out of reverse mortgages.” Photo by Chuck France.

MANAGING DEBT

Avoid carrying credit card debt. Interest paid for credit card bills means less money available for retirement savings. But if circumstances leave you little choice—and to maintain a good credit score—use no more than a 30 percent credit utilization ratio: A $10,000 credit line means carrying a maximum of $3,000. More than one card? Spread the 30 percent over the cards, with the highest balance incurring the lowest interest rate.

25-39: Never let someone else’s image of a successful lawyer drive your spending.

“Financially, you live on student loans in school; and then when you’re working, go off and buy something big you don’t need. That isn’t going to get you where you want to go,” Negrete says. “I pay off credit card charges at the end of every month.”

After the emergency fund is built, pay off debt unless 401(k) eligibility applies. Then calculate the tax-deferred deposits, along with employer matching contributions—no matter how small—to determine the overall financial impact of apportioning money between paying off debt and retirement savings.

40-55: If you are one of the 25 percent of Americans age 50 or older whose job loss increased your credit card debt, get it paid off. Capital One ShareBuilder’s 2012 study found that one in six parents sacrificed retirement savings for kids’ college. If the choice is either your retirement fund or a college fund, consider this: If your financial situation improves, you can always help your children pay down their college debt.

56-70s: To the extent you are relying upon home equity for retirement funding, be realistic about its value, even if it’s a second home.

Retired: Considering a reverse mortgage, in which you receive monthly payments from a lender, secured by your home’s equity? First examine the potential consequences of having debt as a guest in your retirement home.

“After my dilemma, I’d say stay out of reverse mortgages,” says Charles Wheeler, a retired lawyer and physician, about his dispute with a reverse mortgage company that resulted in his home of 40 years being slated for auction at a courthouse in the city hall he once presided over as Kansas City’s mayor in the 1970s (though the auction was ultimately called off).

“Expenses from my wife’s illness drained a lot of equity,” Wheeler says. Foreclosure records reflect unpaid insurance and taxes associated with the mortgage company’s lien. Fortunately, Wheeler’s attorney and others made a comfortable relocation possible.

“I lived longer than I expected. I’m 87 years old, with 63 years of marriage,” Wheeler says. “I’m looking forward to my wife being discharged [from a rehabilitation nursing facility] and coming home.”

Graphics by Adam Weiskind

CARE FOR YOUR HEALTH

Your bank account pays for unhealthy habits. Every dollar spent on medical expenses is a dollar that wasn’t deposited to retirement savings. Learn whether it’s time for a change to your health habits at the RealAge website.

Health and disability insurance are important to financial stability. Some employers are transitioning employees from employer-administered health plans to the Affordable Care Act’s private exchanges. A $95 penalty, or 1 percent of household income, whichever is higher, applies for unenrolled status.

But “affordable” is subject to varying definitions. For example, smokers will pay up to 50 percent more than nonsmokers for coverage.

25-39: “I have life and disability coverage through the firm,” Negrete says. Skeptical about disability insurance? Calculate your disability quotient at whatsmypdq.org, and learn ways to reduce risks at disabilitycanhappen.org.

40-55: Focus on healthy stress re-lievers. For help with substance abuse issues, the ABA Commission on Lawyer Assistance Programs offers resources.

56-70s: Though she’s been diving into health care problems for clients for more than 30 years, Blake’s caregiving experience really opened her eyes.

“Caregiving for our parents, we saw how routine things you don’t think about—like health care equipment and caregiving bills—easily add up,” says Blake. “Uninsured medical expenses or round-the-clock care could easily use up savings. We were, however, fortunate to have parents who carefully planned for their retirement financial needs.”

Research Medicare. The Employee Benefit Research Institute estimates that Medicare covers roughly 60 percent of health care costs for those 65 and older, excluding long-term care coverage. Also, if you plan retirement residences in different states, verify registration with the appropriate state health exchange plan under Affordable Care Act requirements.

Retired: Research long-term care options. Wheelchair ramps, health care aides and the like are in-home services. The MetLife Mature Market Institute estimates an assisted-living community costs $42,600 per year on average.

LIFE EVENT ADJUSTMENTS

Marriages, children, caregiving, deaths, divorces and retirement itself are life events requiring financial planning and, at times, adjustments for both emotional and financial comfort.

Marriage: “Thinking about marriage to someone,” Negrete says, “you need to ask, ‘Is this a true partner in life?’ It’s important because I plan on working a long time and having a family too, so choosing someone who is going to be supportive—and what that means working in this industry—is necessary.

“As a couple you have to think about and talk about things, and so Diego and I talked about goals of things that we want to do or have in five, 10, 20 years.”

That’s good advice considering the second most frequent reason couples separate is disagreements over money. Getting in sync on your financial priorities, including how you save and spend money, before moving forward as a couple is crucial.

Children: If taking parental leave or boarding adult children lands you in a financial hole, try reducing expenses or extending your anticipated retirement date to get retirement savings back on track.

Divorce: A consultation with a professional certified in post-divorce finances should be considered.

Caregiving: Should caregiving for elderly family members become a goal, what are known as TPOPPs are a must-have.

“I saw firsthand how important transportable physician orders for patient preferences are,” Blake says. “TPOPPs improve the quality of care people receive at the end of life.

“My mom’s situation reached a point where she was suffering from chronic pain without an easy antibiotic cure. Physically she was weak, but mentally sharp, and she didn’t want to have lots of invasive treatment.”

A TPOPP goes beyond a durable power of attorney. “It’s an actual physician order that follows the patient, whether the person is in a hospital or nursing facility or living independently and succumbs to an accident or trauma that brings them into the emergency room,” Blake says. “And it guides the care that is provided to the patient along a path that the patient has identified.”

Death: Amid grief, the death of a loved one brings urgent decisions. The American Institute of CPAs prioritizes tasks on its website page for organizing finances after the loss of a spouse.

Graphics by Adam Weiskind

RETIREMENT (AT LAST)

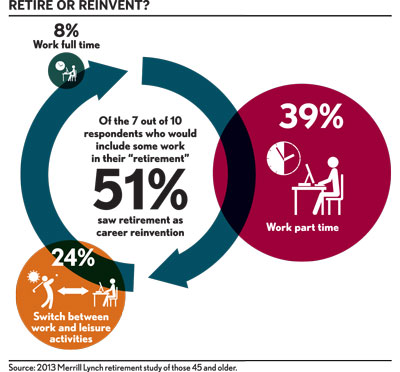

Retire or refocus? To the extent you are one of the 400,000 lawyers whom the ABA estimates are 62 or older, Tacha says, “new life begins at 65.” Her sentiment reflects a 2013 Merrill Lynch retirement study, wherein boomers anticipated working past age 70.

“Not everyone is going to have the opportunity to do what I’m doing or what my husband is doing,” says Tacha, “but that doesn’t mean that older lawyers don’t have anything to contribute. For example, I started a mentor program my first year here in which we pair a volunteering attorney or judge with a new first-year student. Some are retired and some are still working. It’s been very successful for the student and rewarding for the professional.”

Within five years of retirement, learn Social Security’s options. Experiment living on your anticipated retirement budget. Reducing expenses or working longer may be the necessary adjustments if your budget proves unlivable.

Reallocate investments to accommodate retiree status. Adapt your housing situation to fit your financial and health needs. Renting versus owning is a way to reduce taxes and maintenance expenses. A long-term insurance policy for a period of five years or less and an inflation rider should be considered for nursing home care, given that the average stay is 2½ years.

Navigating your path toward a comfortable retirement is easier when armed with a map. When gauging progress, remember President Abraham Lincoln’s wisdom: “I walk slowly, but I never walk backward.”

The economy may tank, stress will still exist and relationship obligations may multiply, but focusing on changing matters within your control moves you forward.

This article originally appeared in the January 2014 issue of the ABA Journal with this headline: “Focus on a Sunny Sunset: There are ways to make retirement anything but resignation.”

Sidebar

Online tools and resources

The Center for Retirement Research at Boston College has interactive tools for targeting retirement savings goals.

ES Planner’s basic option focuses on what you need to know about spending, rates of return and Social Security benefits for purposes of maintaining the same standard of living during retirement.

A Separate Consumer Price Index for the Elderly? is a Congressional Research Service report that looks at the financial needs of the elderly.

Fidelity Investments’ IRA contribution calculator.

Fidelity’s retirement calculator.

T. Rowe Price’s advice and Ready-2-Retire tool.

The Vanguard Group’s retirement calculator.

Vanguard’s investor questionnaire.

Wells Fargo’s asset allocation calculator and questionnaire.

AARP’s retirement tools.

Bankrate.com’s retirement income calculator.

Susan A. Berson is a Leawood, Kan.-based attorney and author of several finance and tax books for lawyers. She will continue her articles on retirement for lawyers in coming months in the ABA Journal Business of Law section. Next month’s column will cover the factors that influence when to retire.