5th Circuit tosses federal judge from sixth case after he 'candidly revealed' disdain for antitrust law

Image from Shutterstock.

A federal appeals court has revived an antitrust lawsuit against Visa and removed the judge who was hearing the case after his “gratuitous comments” suggested “ingrained skepticism” about the plaintiff’s claims.

In an April 5 decision, the 5th U.S. Circuit Court of Appeals at New Orleans removed U.S. District Judge Lynn Hughes in the case filed by Pulse Network.

Hughes, a judge in the Southern District of Texas in Houston, has been removed from five other cases, the court said in a footnote.

Hughes had ruled that Pulse Network didn’t have antitrust standing to pursue its allegations that Visa uses its market dominance to discourage competition in the debit-card networks that connect the banks of merchants and card holders.

The appeals court reversed and agreed with Pulse Network that Hughes should be kicked off the case.

“Pulse’s overarching contention is that the district judge had prejudged the case against Pulse from the outset,” the appeals court said in an opinion by U.S. Circuit Judge Judge Stuart Kyle Duncan. “This is a serious accusation, but unfortunately there is record support for it.”

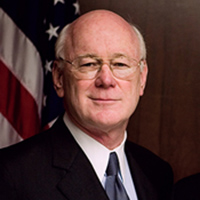

U.S. District Judge Lynn Hughes of the Southern District of Texas in Houston. Photo by the U.S. Government, PD US Courts, via Wikimedia Commons.

U.S. District Judge Lynn Hughes of the Southern District of Texas in Houston. Photo by the U.S. Government, PD US Courts, via Wikimedia Commons.

As an example, the court cited Hughes’ comments during an initial conference in 2015 in which he “repeatedly insisted that the challenged Visa policies did not harm competition,” and that merchants weren’t forced to pay a fixed monthly fee. Those are “some of the key disputed issues” in the case, the appeals court said.

“Pulse also points out that the district judge candidly revealed his disdain for antitrust law and antitrust plaintiffs,” the appeals court said. “For instance, the judge remarked that, ‘There are more bad antitrust cases than any other single category,’ theorized that, ‘The only real monopolies are ones supported by the government,’ and suggested that the Standard Oil Co. wasn’t a real monopoly. Viewed in isolation, any one of these admittedly gratuitous comments might be harmless. Taken together, however, they raise concerns that the judge harbored ingrained skepticism about Pulse’s claims from the jump.”

The court also said the case “languished” as Hughes “repeatedly stymied Pulse’s legitimate requests to engage in critical discovery.” After four years of litigation, Pulse Network was left “without any discovery on aspects of Visa’s policies central to its case,” the appeals court said.

The court said Hughes’ rulings in the case lend additional support to Pulse Network’s arguments for reassignment.

In one instance, after Visa sought to dismiss Pulse Network’s case’s in 2015, it took Hughes nine months to issue a one-sentence order denying the motion, the appeals court said. Then, when Visa moved for summary judgment two years later, it took Hughes 10 months to resolve the motion.

The appeals court described Hughes’ decision on summary judgment by quoting from another case involving Hughes. In that case, Hughes issued a seven-page opinion “with few citations to either record evidence or relevant legal authority … consist[ing] almost entirely of conclusory statements.”

That prior case was one of the five previous cases in which Hughes was removed.

The appeals court noted that reassigning the Pulse Network case “won’t make the new judge start over because even after so much time the case has barely started.”

On the substantive issues, Pulse Network had alleged that Visa foists a fixed-fee pricing structure on merchants that allows it to lower its per-transaction cost, thereby squeezing out debit-card network competitors. The company also alleged that Visa entered into volume-based agreements with merchants that offer incentives to route a certain number of transactions on Visa each month, also harming competitors.

The appeals court concluded that the alleged schemes inflict antitrust injury on Pulse Network, and it can pursue the lawsuit.

The case is Pulse Network v. Visa Inc. Hat tip to Law360 and Reuters, which had coverage of the decision.

See also:

ABAJournal.com: “Federal judge tossed from case for ‘immovable’ views, suggestion that US lawyers are lazy and arrogant”

ABAJournal.com: “Federal judge who said he would ‘crush’ plaintiff’s case prejudged her bias claims, 5th Circuit says”

ABAJournal.com: “Federal judge stays on case after explaining his swastika and Caucasian comments were historical”

ABAJournal.com: “5th Circuit criticizes federal judge for alleged sexist remark about simpler times”