ABA Treasurer's Report

Alice Richmond, ABA Treasurer

Photo by Stephen Sherman

The economic downturn certainly presents an on-going challenge to each of us in our personal and professional lives, as well as to the American Bar Association. Because of the economic volatility created by the recession, my comments about our fiscal year end financial reports need to be seen as part of an ongoing process, rather than exclusively at a particular point in time.

The ABA finances remain strong. We have begun a complete review and revision of our most important financial processes and the technological systems that support them. When we are done, I believe that we will have state of the art systems that will aid us not only today but also in our future growth.

A year ago, I promised you that “…my future reports to you will deal with our projections for the Association’s position in this new economic order.” In keeping with that promise, my comments will focus not only on our 2009 fiscal year results, but will describe issues that may impact our future financial results so that you can directly understand some of the challenges that will face the ABA in the near and longer terms.

ABA TREASURER’S REPORT FOR THE FISCAL YEAR ENDING AUGUST 31, 2009

For the fiscal year ended August 31, 2009, the Association’s consolidated revenues exceeded our expenses by $5.1 million. Given the uncertainties of last year, this is an extraordinary result. However, we need to understand the “good news” of this surplus in a broader context. Over the years, all of you have heard the phrase “Dues Warehouse.” Simply stated, the Dues Warehouse represents a surplus from dues revenue that is not needed to fund operations during a given fiscal year. Said slightly differently, the Dues Warehouse is used to ensure that we do not have a “deficit” budget. For the fiscal 2009 budget, that is the year that began on September 1, 2008, and ended on August 31, 2009, we transferred $3.3 million from the Dues Warehouse (surplus) to balance the ABA’s General Revenue budget. In varying amounts, we have taken this action nearly every year. At the end of fiscal 2009, $3.3 million of the ABA’s operating surplus of $5.1 million was an amount that we had predicted that we would need but ultimately did not use. This $3.3 million was “returned” to the Dues Warehouse for future use. As of December 31, 2009, the Dues Warehouse contained $14.1 million. Thus, if one excludes this $3.3 million, the ABA recorded an operating surplus of about $1.8 million in FY2009 which, all things considered, is a major accomplishment.

Other good news involved reducing the ABA’s debt on its real estate, both owned and rented. As you all know, the ABA owns its headquarters building in Washington, DC, near the White House and the Department of the Treasury. During FY2009, we reduced the mortgage debt on our DC headquarters, as well as the debt incurred in the build-out of our Chicago offices, by a total of $2.8 million. We will soon have to make some strategic decisions about our Washington building, and reducing our mortgage indebtedness positions us to take maximum advantage of the available options.

The ABA’s complete and consolidated financial reports are audited on an annual basis by Ernst & Young, the ABA’s outside auditors. Despite substantial personnel changes in the Financial Services department in the past six months, we received a “clean” audit opinion for all the ABA’s activities including the A133 Audit, which examines all funds the Association receives from the federal government. This is good news on many fronts and is an indication that the Association’s internal controls, accounting and financial reporting are working, reliable and accurate. The combined audit included the ABA, the Fund for Justice and Education (“FJE”, our 501c(3) entity through which all grant income flows), the ABA Museum and the James O. Broadhead Corporation (which owns the Washington, DC, ABA building).

As of August 31, 2009, the Association’s consolidated net assets totaled $107.8 million, a 30% decrease (or $46.5 million) from the prior fiscal year’s end (August 31, 2008). This decline, which is substantial, primarily reflects declines in the ABA’s long-term investments and increases in the ABA’s pension liability.

OTHER FINANCIAL RESULTS FOR THE FISCAL YEAR 2008-2009

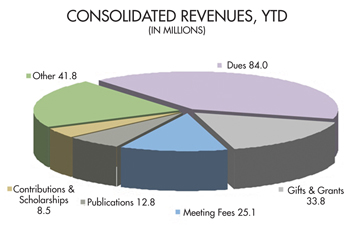

As of August 31, 2009, the Association’s consolidated operating revenue was $206.0 million, a reduction of $4.7 million from the same time in 2008. Dues revenue from General Operations, at $68.5 million, continues to be the Association’s largest revenue source. Section dues revenue added another $15.5 million. Both of these categories continued a downward trend in FY2009. The Board of Governors, in conjunction with the Standing Committee on Membership aided by the ABA staff, have extensively studied these trends and analyzed the available data. The ABA dues reduction proposal, which was considered by the House of Delegates at the FY2010 Midyear meeting, is part of a larger effort to first address, and then reverse, the downward trend of dues revenue.

The figure below illustrates the mix of these consolidated revenue sources.

FY2007 was the last year the ABA raised dues. Since then, there has been a decline in overall dues revenue and an accompanying decrease in ABA membership. Part of this decline may be a consequence of the economic turmoil of the past 18 months. But it is also likely that we need to be more proactive about the benefits of ABA membership.

We have improved our efforts to seek and obtain grants and gifts to fund ABA activities. As a result, ABA gifts and grants have increased by approximately $0.5 million, year-over-year, to a revenue total of $39.6 million; including scholarships, the total is $50.9 million.

The FJE has received approximately 125 grants from the United States Agency for International Development (“USAID”), the U.S. State Department, U.S. Department of Justice as well as several non-U.S. government sources such as The Bill and Melinda Gates Foundation, the Casey Family Foundation, the Embassy of the Netherlands, and the European Commission. The grants being implemented domestically focus on Children and the Law, Domestic Violence, Immigration, Law and Aging, and Legal Education.

The ABA’s Rule of Law Initiative (“ROLI”) continues to pursue opportunities to expand and affirm the rule of law throughout the world. The American Bar Association “brand” and its accompanying prestige is sought after and valued by funders and NGOs operating on projects from the most remote outpost to major metropolitan areas. ROLI’s grants, focusing as they do on Human Rights, Judicial and Legal Reform, Women’s Rights, and Judicial Education in approximately 30 countries throughout the world, represent the realization of the ABA’s goals and our highest aspirations.

Grant activity continues to be strong and we anticipate that we will exceed our budgeted revenue of $49.3 million for the fiscal year 2010. There are several grant proposals pending approval with funders and we anticipate maintaining a steady volume of grant activity in the current year.

The ABA Fund for Justice and Education also solicits and accepts charitable contributions from individuals, law firms and corporations to support the Association’s public service work. Despite the challenging economic times, contributions to specific FJE-supported programs continue to be strong, providing critical revenue support to these important programs.

Meeting fees continue to be a major source of income for the Association with the Sections generating $17.6 million in meeting fees while the ABA’s General Operations totaled $6.5 million. Consolidated meeting fees were down $4.2 million against the prior fiscal year, primarily due to general economic conditions and the general decrease in business-related travel. However, meetings and travel expense also declined in FY2009 by a similar amount.

Publications revenues also fell by $1.0 million to $12.8 million in FY2009, primarily due to declining demand for books, pamphlets and periodicals driven by the recession and by the generally increasing use of the internet and digital media.

See the following chart for additional detail on major non-dues revenue categories, excluding gifts and grants.

The ABA’s financial position changes not only in response to its generation of revenue but also as a result of monitoring and controlling its expenses. The Association’s consolidated expenses declined in FY2009 against the prior fiscal year by $2.7 million. For fiscal 2008-2009, expenses for general operations, section activities, grant programs, the James O. Broadhead Corporation and the ABA Museum were $200.9 million, a 1.3% decrease from fiscal 2007-2008, primarily reflecting stricter expense management. Expenses in this context include everything from personnel costs, travel, hotel and other meeting expenses, to printing and postage for our many publications. The figure below illustrates the various expense categories across the Association.

On a consolidated basis, salaries, wages and benefits for FY2009 increased $5.9 million, or 7.3% over FY2008, driven by increases in employee pension and health care costs and salary adjustments made to bring ABA staff salaries in line with comparable market averages. In FY2009, salaries of $87.9 million and facilities expense of $21.4 million together represented $109.3 million, or 54% of the ABA’s total spending. Consolidated FY2009 printing and publications expenses declined by $2.7 million to $20.7 million due to aggressive cost reduction activities.

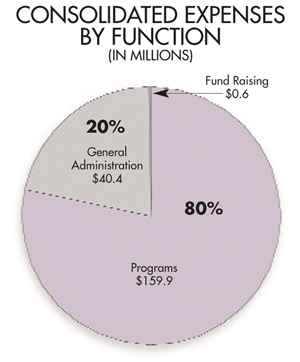

The ratio of program expenses to total expenses is often a gauge of a not- for-profit organization’s efficiency. In general, the higher the ratio of program-related expenses to total dollars spent, the more effective the organization is deemed to be in furthering its mission. The chart below illustrates the percentage of ABA expenses dedicated directly to our programs compared to the amount we spend on support services. For the fiscal year ended August 31, 2009, the ABA’s program expenses represented 80% of total expenses, a slight improvement from 79% for FY2008. According to a University of Wisconsin-Milwaukee study, Program Service Expense ratios for not-for-profit organizations of the ABA’s size range from 74% to 89%. Thus, we are doing well and trending in the right direction, but there is room for improvement. We will be revisiting this calculation on a regular basis.

Due to external market conditions, the value of the ABA’s investments fell nearly $24.6 million from August 31, 2008, to August 31, 2009, a stunning 12% decline. However, in the four-month period from September 1, 2009, through December 31, 2009, our investment portfolio recovered $4.7 million, a reflection of the broader recovery in the financial markets. This gain, however positive, is a further illustration of the volatility of the investments which underpin the Association’s financial health.

For the three-year period ending December 31, 2009, the ABA’s investments beat the three-year benchmark by 3/10th of a percent, or -1.3% for the ABA compared to the benchmark loss of -1.6%. We have begun the process of identifying less volatile assets to enable us to take greater advantage of market opportunities without a significant increase in risk.

In FY2009, we contributed $8.1 million to the AEFC Pension Plan, the Association employees’ pension plan, to satisfy the funding requirements of the defined benefit plan under ERISA. Over the year ended August 31, 2009, the unfunded pension liability rose $26.2 million, from $19.2 million to $45.4 million, due to a variety of factors including declines in the financial markets, decreases in interest rates and changes in the governing federal law. The calculation that determines our unfunded pension liability considers declines in invested assets, additional benefit accruals, and changes in the discount rate. The discount rate is a key assumption used by our actuaries to project the ABA’s total benefit obligations under the plan. As the discount rate declines, which it has from 6.25% to 5.60%, the pension liability increases.

The assets invested through Northern Trust for the benefit of the pension plan have recovered along with the broader market since August 31, 2009, to $90.6 million at December 31, 2009, representing a recovery in pension plan assets of $4.0 million. The following chart illustrates the impact of this recent market volatility on pension plan assets.

The Board of Governors continues to examine ways to minimize the unpredictable financial consequences of the pension to the Association while recognizing the importance which this employee benefit has for our exceptional and loyal staff.

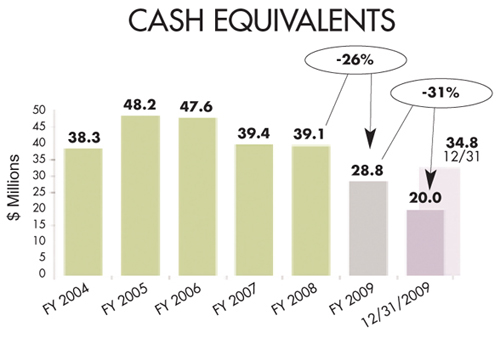

Each year, the ABA receives substantially all of its positive cash flow in June, July and August with the regular dues payment cycle. This large, seasonal influx of cash is then used over the succeeding nine months to pay for the Association’s general and administrative expenses. The next dues cycle replenishes the cash balances and the process begins again. This system is neither very efficient nor, in these tumultuous times, very reliable.

To avoid this problem and to address the larger issues, the Association’s Financial Services staff has begun to develop a cash flow analysis and management tool. We have created a cash flow simulation model to anticipate cash inflows, outlays, and the impact of strategic initiatives. This model will enable the ABA to bridge the leaner cash months. In the longer term, such a model will assist us in assessing the impact of strategic initiatives and the timing of their implementation.

The following chart demonstrates the trends in the Association’s cash balances over the past five fiscal years.

At the end of FY2009, after a detailed analysis and with the agreement of our auditors, the Association recorded unsold ABA publishing inventory at $2.0 million. Following generally accepted accounting principles, the Association recognized the value of books that have been published but not yet sold as an asset on the Consolidated Statements of Financial Position. The result of this change was to reduce ABA non-operating expenses by $2.0 million and increase ABA assets on the ABA consolidated balance sheet by $2.0 million.

The ABA’s consolidated liabilities at year’s end were $140.7 million, $23.2 million higher than at the prior fiscal year end. As previously noted, a significant portion of this increase was due to a $26.2 million rise in the ABA’s pension liability, partially offset by the net of declines in other liability categories such as long-term debt and deferred revenue.

An increase in consolidated liabilities usually can be seen in a decline of net assets and this certainly was the case. There was a $46.5 million decrease in the ABA’s net assets from FY2008 to FY2009, continuing a trend that began with a $36.2 million decrease in FY2008 from FY2007.

A primary cause of the decline in net assets this fiscal year is the recognition of the net additional, actuarially determined ABA pension liability of $26.2 million.

A secondary cause of decline in net assets is from realized and unrealized investment losses of $19.7 million. This was substantially due to loss of market value in the ABA’s long-term investment portfolio, as a result of the economic downturn and the poor performance of the ABA’s invested assets.

The American Bar Association received notice on January 22, 2010, that Standard & Poor’s has completed a review of their ratings for the ABA’s debt and has reaffirmed a rating of ‘AA’ for the ABA, with a stable outlook.

A VIEW OF THE CURRENT ECONOMIC CONDITIONS

The ABA “Permanent Reserve” is a hedge against swings in revenue and other unforeseen events having an economic impact on the Association’s activities. As a general policy, it is prudent to have 50% of an organization’s annual general operating expenses in such a “reserve.” At August 31, 2008, the ABA’s Permanent Reserve was down to $50.2 million, which is approximately 46% of our annual General Operating expenses of $107.5 million. By August 31, 2009, the Permanent Reserve stood at $44.2 million, a drop of nearly $6 million from the prior year. As of December 31, 2009, the Permanent Reserve has recovered to $46.6 million against budgeted general operating expenses of $106.8 million, a ratio of 44%. The ABA remains slightly below our 50% of operating expense target and will need to replenish this important part of the Association’s solid financial foundation.

Kathryn Shaw

Photo by Kristine A. Strom

LOOKING AHEAD

This past year has certainly presented significant financial challenges for the ABA, as well as for all of us. I am very pleased to report that we have made strong efforts to manage those things which are within our control. We have challenges ahead, including the decline in dues revenue, our growing pension liabilities and our need to meet the problems of the cyclicality of the ABA’s cash receipts. But I am confident that we will solve these problems and, in the process, create a better financial services function at the ABA. I would like to welcome Kathryn Shaw, our new chief financial officer who comes to us from Siemens. She began working for us before she was officially on the payroll and her capacity for work is astounding. She has already created a high-performance financial services team. They see their mission as providing accurate, complete and timely financial reports to the entire ABA family. Our overriding goal is improved customer service and we would like you to let us know if you feel we don’t meet that goal.

Despite these tumultuous financial times, I continue to be honored to serve as your Treasurer. The more I see of what we, as an organization, do, the more I understand how the efforts of each of us contribute to achieving the goals of defending liberty and pursuing justice. I promised to increase transparency, communication and understandability of our financial reports and I would be grateful for any feedback about how we are doing in that regard.

If you would like a copy of the ABA’s consolidated financial statements for the year ended August 31, 2009, as audited by Ernst & Young, and the related audit report, please send an email either to me or to Nadine Nunley, Kathryn Shaw’s very efficient executive assistant, at .(JavaScript must be enabled to view this email address). Finally, if you have any questions or comments about this Treasurer’s Report or any aspect of Association finances, please contact me at .(JavaScript must be enabled to view this email address). Thank you again for your support and your interest in the financial health of the Association.