Justice Thomas listed income from a real-estate firm even after it closed in 2006

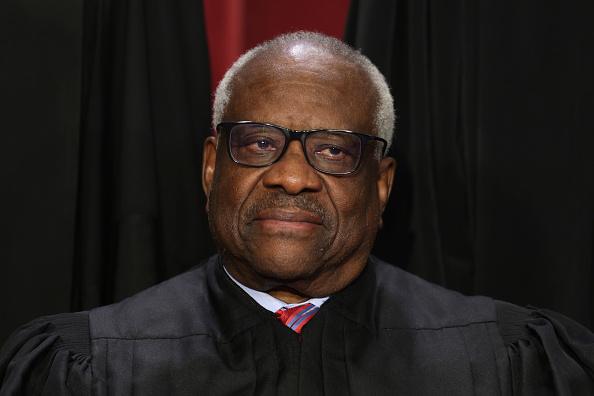

Justice Clarence Thomas. (Photo by Alex Wong/Getty Images)

Justice Clarence Thomas has listed hundreds of thousands of dollars in household income from a Nebraska real-estate firm on his disclosure forms over the last two decades—even after the firm closed in 2006.

Thomas’ wife, Ginni Thomas, was initially listed as a partner in the company, Ginger Ltd. Partnership, along with her parents and three siblings, the Washington Post reports. The company owned and leased residential lots in two developments outside Omaha.

In 2006, the Ginger Ltd. Partnership disbanded and its residential lots were transferred to a new company, Ginger Holdings LLC. The new company’s business address didn’t change from the old one. State incorporation records for Ginger Holdings don’t mention Ginni Thomas, according to the Post.

“The previously unreported misstatement might be dismissed as a paperwork error,” the Washington Post reported. “But it is among a series of errors and omissions that Thomas has made on required annual financial disclosure forms over the past several decades, a review of those records shows. Together, they have raised questions about how seriously Thomas views his responsibility to accurately report details about his finances to the public.”

Other financial disclosure issues included:

• Thomas was treated to vacations, private jet flights and yacht cruises by GOP megadonor and billionaire Harlan Crow, according to an April report by ProPublica. Thomas said he was following advice when he didn’t report the trips. Ethics experts said failure to disclose the jet flights may have violated a Watergate-era law on gift disclosures.

• Thomas didn’t report that a company owned by Harlan Crow bought a home and two vacant lots from Thomas in 2014, ProPublica reported in April. Thomas’ mother continued to live in the home. Experts said Thomas’ failure to disclose the sale appears to violate a federal disclosure law that applies to justices and other officials.

• Thomas failed to report more than $686,000 in income his wife earned while working for the conservative Heritage Foundation, Common Cause alleged in 2011. At the time, Thomas said the information was “inadvertently omitted due to a misunderstanding of the filing instructions.”

• Thomas amended his disclosure form in 2020 after failing to report reimbursements for travel costs incurred to teach at two law schools. He did, however, disclose the teaching income. The group Fix the Court flagged the issue. (Justice Sonia Sotomayor also failed to disclose reimbursements for a commencement speech, Fix the Court said.)

Thomas and his wife did not respond to the Washington Post’s request for comment on the defunct real-estate firm.